Message from the Executive Officer

in Charge of Corporate Planning and

Finance

Financial and capital strategies in the Medium-term Management Plan

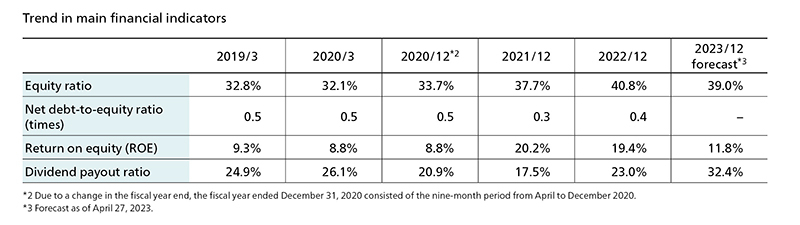

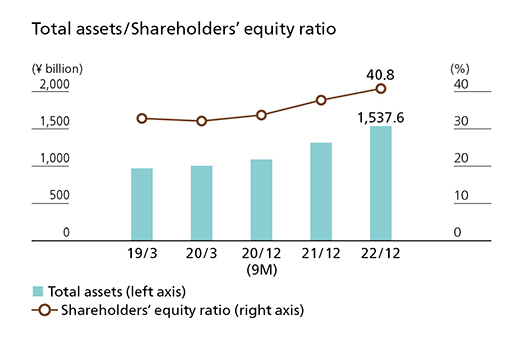

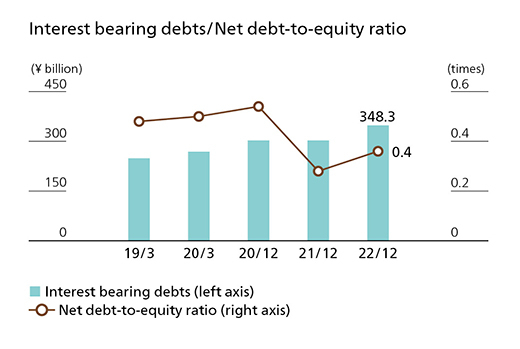

Under the current Medium-term Management Plan, we are diversifying our U.S. housing and real estate business, which has been a pillar of earnings, and restoring the earnings power of the domestic housing business, which was an issue in the previous Medium-term Management Plan, as well as promoting investments and initiatives in decarbonization-related businesses. As a period to gain a foothold toward the realization of our Long-term Vision, we believe that it is necessary to build an earnings base and actively invest in growth areas, and that it is important to maintain both financial soundness and profit growth fully aware of capital efficiency. Specifically, we aim to further enhance our corporate value by investing in growth for the future while maintaining financial soundness with an equity ratio of 40% or more and a net debt-to-equity ratio of 0.7 times or less, as well as stably achieving high profitability with ROE of 15% or more.

ROE in excess of the cost of equity

In the fiscal year ended December 31, 2023, net sales totaled 1,733.2 billion yen (up 135.2 billion compared to the initial forecast), recurring income was 159.4 billion yen (up 39.4 billion yen), net income was 102.5 billion yen (up 25.5 billion yen), and ROE was 14.8% (compared to the initial forecast of 11.8%), thanks to growth in the U.S. single-family homes business and improved profitability in the domestic housing business.

We recognize that the Company's cost of equity is approximately 7%, and ROE has been significantly exceeding this cost. As for the target of ROE of 15% or more, the level of difficulty has increased compared to when the Medium-term Management Plan was first formulated due to the increase in foreign currency translation adjustment accounts included in net assets amid the depreciation of the yen, but in order to achieve the target, we must first focus on the profits of the Global Construction and Real Estate segment, which accounts for 70% to 80% of total profits. In particular, we believe it is important to increase profits in the U.S. single-family homes business within this segment, which has a large weighting and relatively high profitability.

In the U.S. housing market, the supply-demand relationship for new homes remains tight against the backdrop of an increase in the population of home buyers, including Millennials and Generation Z, along with a shortage of available existing homes in the market. Although it will be affected by interest rate movements in the short term, we believe that the market will continue to grow in the medium to long term.

In 2023, we expanded into Florida and also actively promoted other initiatives to grow sales and profits, improve profitability, and prepare for labor shortages, such as promoting the FITP*1 business, which provides integrated panel design, manufacturing, delivery, and installation. In addition to our housing and real estate business in the U.S., over the past few years, we have been promoting countermeasures such as improving profitability in the domestic housing business by reviewing sales prices in response to soaring material prices and by rationalizing building processes, reducing our asset holdings by selling some nursing homes to domestic funds, and reducing cross-shareholdings. With regard to cross-shareholdings, the Board of Directors periodically verifies whether they will lead to an increase in the Company's corporate value, and if it is determined that the rationality or necessity of the shareholdings cannot be confirmed, the cross-shareholdings are reduced. In 2023, we sold eight issues, six of which were sold outright. We will continue to aim for profit growth fully aware of capital efficiency throughout the Group.

*1 Fully Integrated Turn key Provider

Increasing P/E and P/B ratios

From 2020 to 2022, our P/E ratio was low due to uncertainty about the outlook for the U.S. housing market while EPS grew, but it has improved recently due to increased dividends and enhanced disclosures along with growth in profits. Our P/B ratio has also improved from below 1.0 times to 1.5 times in May 2024.

In order to further improve our P/B ratio, we will improve ROE by increasing profits centered on further growth of our housing and real estate business in the U.S. and investing aggressively with full awareness of asset efficiency. At the same time, we will strive to improve our P/E ratio by further expanding opportunities for dialogue with stock markets, such as by enhancing disclosure of growth businesses and financial and capital strategies.

Actively investing in growth to achieve our Long-term Vision

In order to improve ROE and ROIC, we have adopted IRR as a quantitative criterion for new investments, and in principle, it is a requirement that efficiency indicators such as IRR calculated from the business plan exceed the hurdle rates (WACC, etc.) set by country and business.

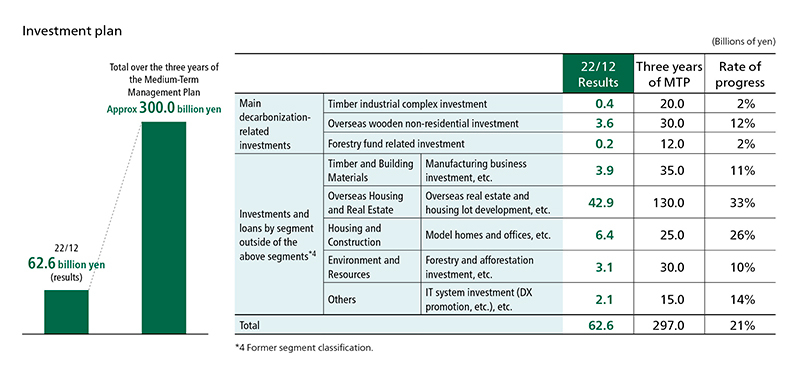

Under the Medium-term Management Plan, we plan to invest a total of approximately 300.0 billion yen over the three-year period, of which 62.0 billion yen are allocated for decarbonization-related investments, such as forest funds, timber industrial complexes, and overseas wooden nonresidential buildings. The cumulative amount of investments and loans over the past two years has been 178.7 billion yen, and although there are differences by item, overall progress has been steady. Specific investments and loans in the fiscal year ended December 31, 2023 include the acquisitions of JPI, a company that develops and constructs multi-family housing in the U.S., a truss manufacturer related to the FITP business, Southern Impression Homes, which sells single-family rentals in Florida, and investments in overseas wooden office building development projects. We will continue to actively invest in growth based on the business policies set forth in our Long-term Vision.

Accumulating real estate for sale to reach our target annual sales in the U.S. of 23,000 units by 2030

Apart from the aforementioned investment and loan plan, we are also acquiring real estate for sale, mainly land for housing in the U.S., where demand for housing is expected to be resilient, and we are paying particular attention to risk control and improving inventory turnover.

By imposing certain restrictions with an established limit on real estate for sale as an investment rule, we manage the situation to prevent excessive inventory levels. The concept of the investment limit is that even in the event of a certain loss, financial soundness will not be significantly impaired. Based on these concepts and rules, we are controlling the balance of real estate for sale. In addition, by using option contracts and land bankers, we are striving to secure land with less risk. With regard to the procurement of funds for the acquisition of real estate for sale in the U.S., we have established certain covenants for each subsidiary to maintain the financial soundness of subsidiaries and control the balance of real estate for sale.

In order to achieve our target of selling 23,000 units annually in the U.S. by 2030, it is essential to continuously acquire real estate for sale. We will continue to strive for sound growth in our business through a system to control inventory risk as well as our growth strategy.

Maintaining financial soundness to support medium- to long-term growth

In order to achieve the Medium-term Management Plan and realize the Long-term Vision, we must maintain financial stability and soundness that can withstand the effects of economic fluctuations. This is especially important in the context of the expansion of our housing and real estate business in the U.S., which is sensitive to market conditions. Over the years, we have been working to maintain financial soundness, and in May 2024, our credit rating from a domestic credit rating agency*1 was upgraded from "A" to "A+" in recognition of our stronger earnings base, particularly in the U.S. housing business. Although the balance of interest-bearing debt has increased due to business expansion, the equity ratio has been maintained at 40% or more and the net debt-to-equity ratio has been kept at 0.7 times or less.

In addition to investing in and financing decarbonization-related businesses as set forth in our Long-term Vision, we expect an increase in demand for funding, including for the acquisition of real estate for sale, mainly in the U.S. housing market, and the expansion of our real estate development business. We will continue to maintain financial discipline while balancing aggressive investment in growth and financial soundness.

*1 Rating and Investment Information, Inc.

Discussing the next Medium-term Management Plan including shareholder return policy

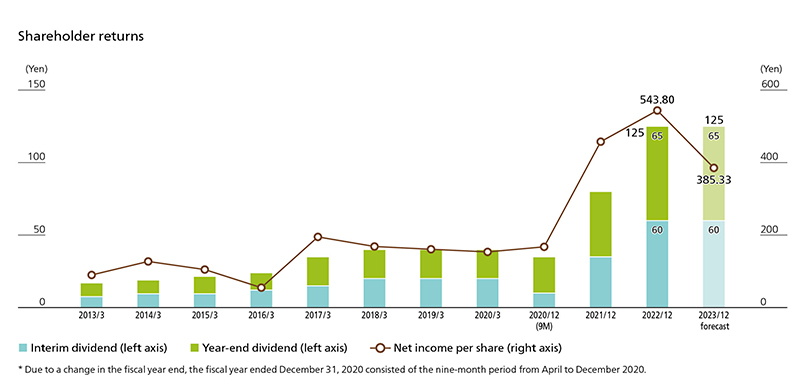

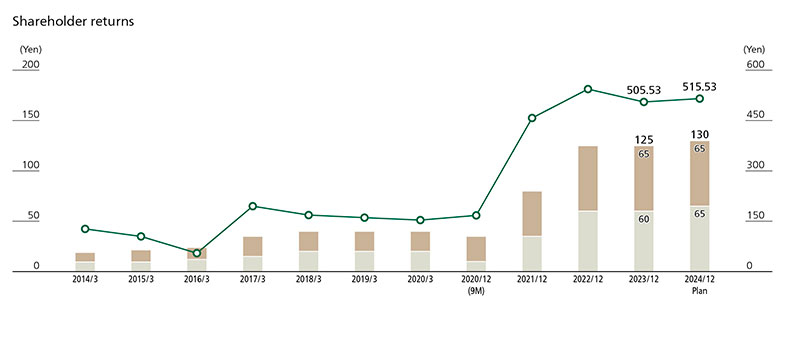

We recognize that returning profits to shareholders is one of our most important issues, and our current basic policy is to implement this on a continuous and stable basis. In the fiscal year ended December 31, 2023, income decreased, but the annual dividend per share was 125 yen, the same as the previous fiscal year. For the fiscal year ending December 31, 2024, we plan to increase the annual dividend per share by 5 yen to 130 yen per share.

We are currently actively discussing the details of the next Medium-term Management Plan, which begins in 2025, and we would like to present a more concrete path toward achieving our Long-term Vision for 2030. We will continue to invest in growth centered on our housing and real estate business in the U.S. and decarbonization-related businesses, while at the same time improving capital efficiency and providing appropriate shareholder returns.

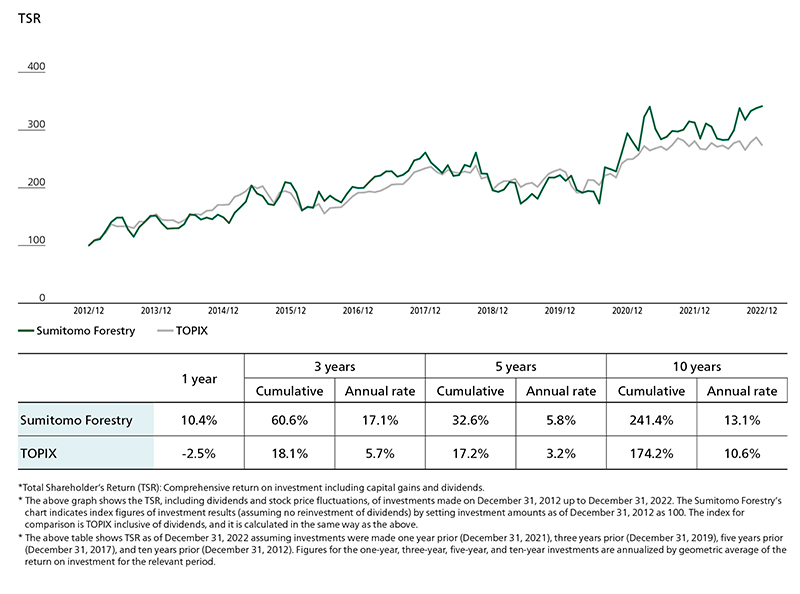

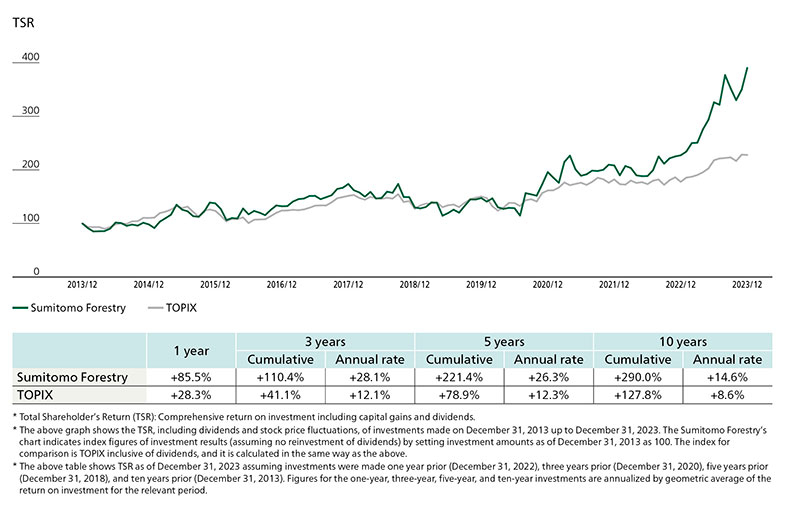

Our TSR over the past 10 years has been 290.0% cumulatively, outperforming TOPIX. Going forward, we will continue to engage in dialogue with shareholders, investors, and many other stakeholders, and appropriately utilize their suggestions and opinions in the management of the Group, which will lead to an increase in corporate value.

Nobuyuki Otani

Director and

Managing Executive Officer

Director and

Managing Executive Officer