Top Message

Sumitomo Forestry's value creation by wood

Long-term Vision Mission TREEING 2030

In 2022, the Sumitomo Forestry Group formulated its Long-term Vision Mission TREEING 2030, outlining

our goals for 2030. In this Long-term Vision, we aim to provide three values to society through our

business activities: namely, value for our planet, value for people and society, and value for the

market economy. One of the pillars of our business policy is maximizing the value of forests and

wood to realize decarbonization and a circular bioeconomy.

Since our founding in 1691, our Group has consistently been involved in wood-related businesses.

Wood has an important function known as carbon sequestration, storing carbon from the CO2 absorbed

during its growth. By continuing to use logged wood for wooden buildings and furniture, carbon can

be retained for a long period of time without being released into the atmosphere. At present, as

global demand for decarbonization as a measure against global warming increases, we believe that our

Group, which is expanding various wood-related businesses globally, will play an ever-expanding role

in the future.

We call our unique value chain, centered on wood and ranging from forest management to distribution

and manufacturing of timber and building materials, wooden constructions, and biomass power

generation, the Wood Cycle. By expanding this cycle globally, we will contribute to the realization

of a decarbonized society through our business activities, as well as the conservation of the global

environment, including biodiversity, contributions to people and society, and the creation of

economic value. We are convinced that circulating the Wood Cycle through our own business activities

will also lead to the realization of Sumitomo's Business Spirit of "Benefit self and benefit others,

private and public interests are one and the same."

Review of the previous Medium-term Management Plan

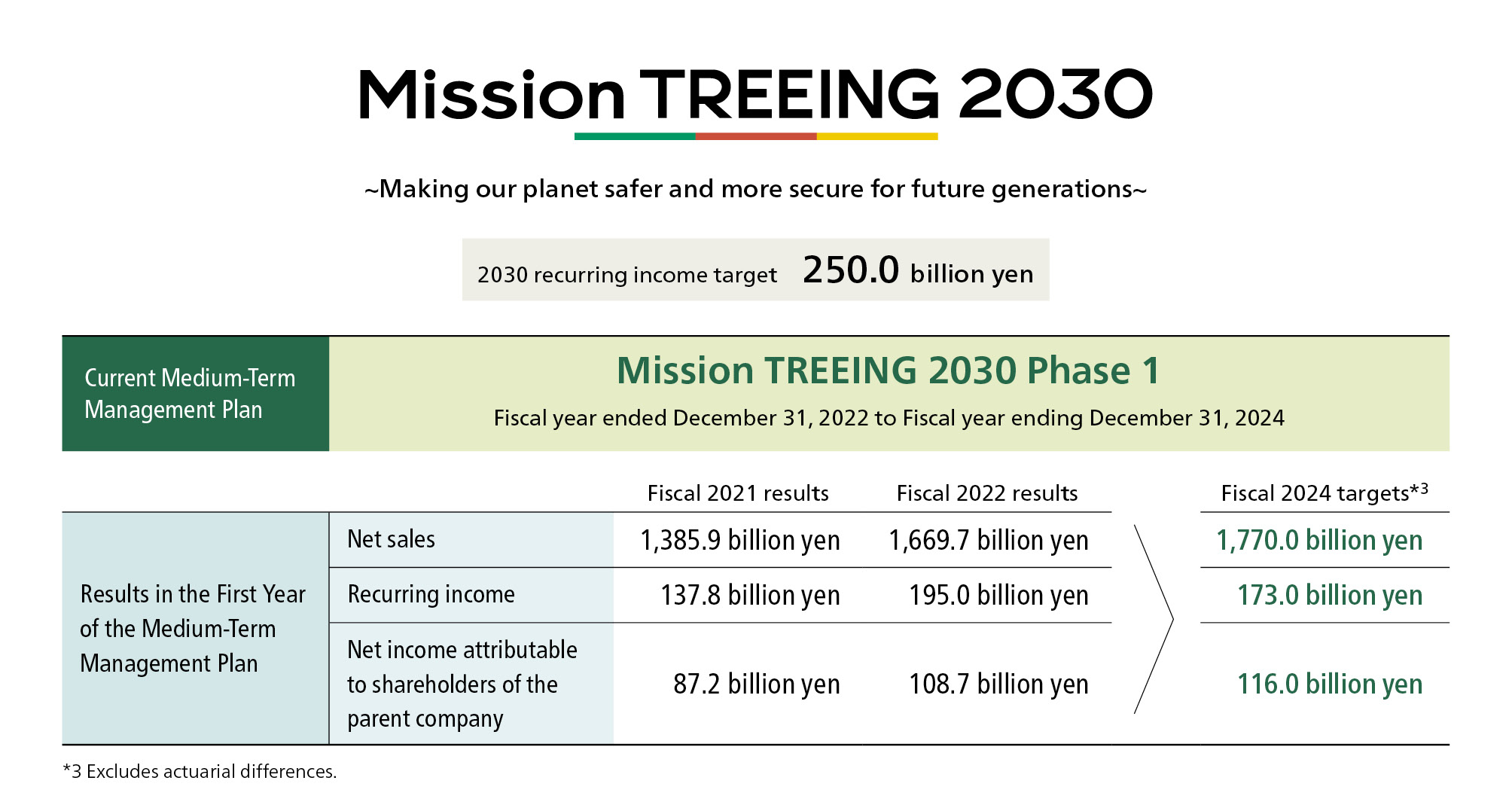

During the three-year period from 2022 to 2024, which corresponded to Phase 1 of our Long-term

Vision Mission TREEING 2030, we made progress toward laying the groundwork for future growth and

contributions to decarbonization based on five basic policies: namely, 1. Efforts to address

decarbonization challenges using wood resources; 2. Promotion of a more resilient earnings base;

3. Acceleration of global expansion; 4. Strengthen management base for sustainable growth; and

5. Further integration of business operations and ESG. We achieved net sales of 2,053.6 billion

yen, surpassing 2 trillion yen for the first time, and recurring income of 198 billion yen,

surpassing the initial plan of 173 billion yen by 25 billion yen to reach a record high,

according to our consolidated financial results for the fiscal year ended December 31, 2024, the

last year of the plan. Mainly with the help of the U.S. single-family homes business, the Global

Construction and Real Estate business greatly surpassed the Medium-term Management Plan's goals.

The domestic housing business also met the goals, primarily due to higher sales prices and

profit margins in the primary custom-built detached housing business and the profit

contributions of subsidiaries. However, weak domestic and international market conditions made

it difficult for the Timber and Building Materials Business and the Environment and Resources

Business to operate, offsetting the steep rise in timber prices brought on by the wood

shock.

In the Global Construction and Real Estate Business, we have used locally-driven management to

establish advantages in our U.S. spec homes business, which is concentrated in the Sunbelt

region where demand for housing is robust. In addition, rising mortgage rates have created a

lock-in effect,*1 reducing the number of existing homes, which account for approximately 90% of

the entire single-family home market, that come onto the market, but this has actually worked to

the advantage of new home builders. In the U.S. real estate development business, we increased

our position in multi-family rental housing starts to fourth largest nationwide, following the

acquisition of JPI, which added to the existing capacity of Crescent. The U.S. real estate

development market is currently facing a tough environment, with the issues of supply shortages

and single-family home affordability*2 emerging. Therefore, we will grow our multi-family rental

housing business from the medium- to long-term perspective of the chronic housing shortage.

1 Lock-in effect: The tendency to refrain from selling an existing home when refinancing from a low interest rate to a high interest rate is required. 2 Affordability: Refers to the ability to pay for a home, and is evaluated as the percentage of housing costs (rent or mortgage payments) to household income.

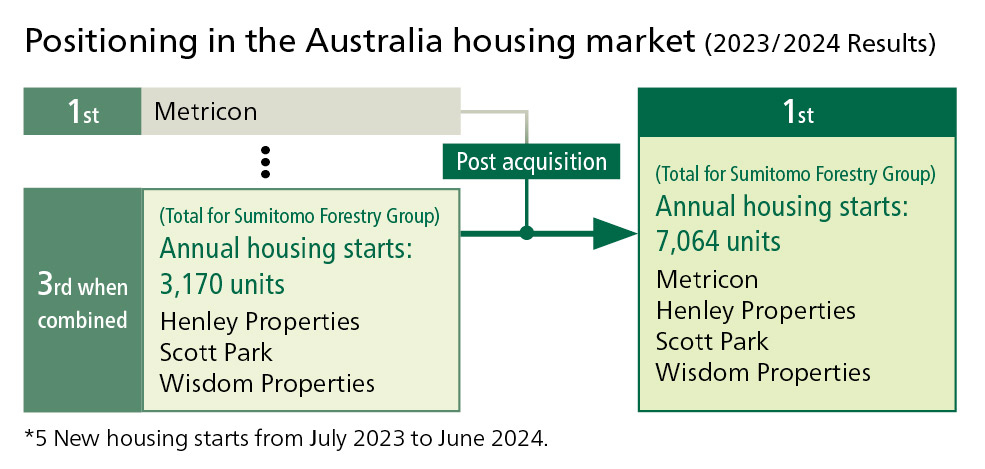

In the single-family homes business in Australia, inflation caused material prices and labor

costs to rise, while the COVID-19 pandemic caused chronic bottlenecks in administrative

procedures and significant delays in construction progress, resulting in a challenging situation

for some time. However, performance is recovering due to the significant increase in demand,

mainly from first-time home buyers in Western Australia as well as the increase in sales prices

and improved profit margins across the country. In November 2024, we acquired Metricon, the

country's largest homebuilder, making it a consolidated subsidiary, thereby gaining an

overwhelming share of the single-family homes business in Australia.

In the domestic custom-built detached housing business, profitability deteriorated due to

soaring prices for timber and various construction materials caused by the wood shock from 2021

to the end of 2022. However, by promoting the digitalization of marketing, including the

expansion of our website, and restructuring our product strategy from first-time home buyers to

high-net-worth individuals, and thanks to the effect of gradually increasing prices, we were

able to secure orders while improving our sales prices and recovering our profit margins. On the

other hand, in the Timber and Building Materials Business, the market environment remained

challenging due to a decrease in the number of new housing starts and other factors. The

Environment and Resources Division's forestry business suffered from a decline in the export log

market, particularly to China, and increased expenses related to establishing reforestation

sites, while the renewable energy business's profitability declined as a result of rising wood

fuel prices.

In terms of forests, under our business policy to accelerate circular forest management, we

have

seen steady progress in the acquisition of forest assets through our first forestry fund.

Combined with the areas that we have traditionally owned and managed, the area of forests we are

managing had reached 365,000 hectares as of the end of 2024. In addition, in the area of wood,

under our approach aiming to promote wood change, we launched our first timber industrial

complex called Kowa-no-mori in Iwaki City, Fukushima Prefecture, and are preparing to begin

commercial production in 2026. In Mission TREEING 2030 Phase 1, we actively invested in M&A and

new businesses to achieve our Long-term Vision. Following this, we are now working to complete

the PMI*3 process to reap the benefits of these investments. We have secured approximately

80,000 lots, equivalent to more than seven years' worth of sales based on our 2024 results,

which will be essential for expanding our single-family homes business in the U.S. However, it

is becoming increasingly important to operate our business with an awareness of capital

efficiency and inventory turnover. In terms of bottom line, we achieved our company profit

target. However, we are heavily dependent on our overseas single-family homes business, and

there are noticeable delays in our Timber and Building Materials and Environment and Resources

businesses when it comes to achieving the targets of the Medium-term Management Plan. Therefore,

we will closely examine each issue, identify businesses that need to be strengthened and

improved, and those that need fundamental review, and reallocate management resources to

optimize the overall situation.

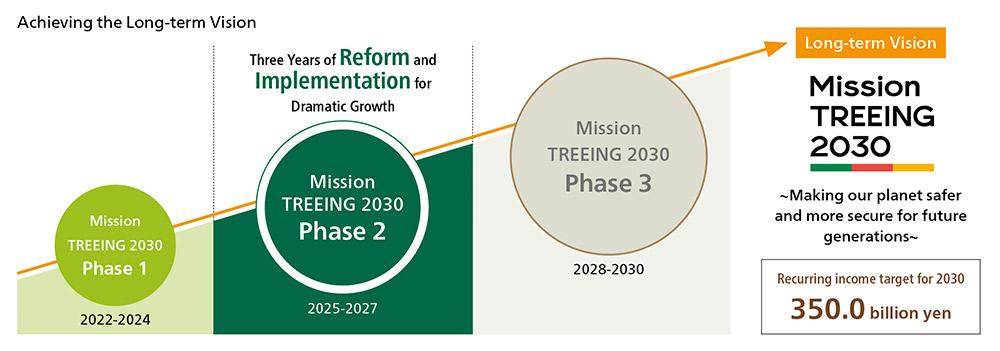

New Medium-term Management Plan Mission TREEING 2030 Phase 2

The Group has formulated its new Medium-term Management Plan Mission

TREEING

2030 Phase 2, which

will serve our Long-term Vision for the three-year period from the fiscal year ending

December

2025 to the fiscal year ending December 2027.

The overall theme of this new Medium-term Management Plan is to dedicate "three years of

reform

and implementation for dramatic growth." We aim to achieve sustainable and steady profit

growth

by maintaining financial soundness and continuing to make aggressive investments.

Basic policy

The new Medium-term Management Plan sets out five basic policies. We will continue to deepen our

global expansion, strengthen our management base to improve our earning power, contribute to

decarbonization through our business activities, and further integrate our business operations

and ESG.

The business environment that forms the premise of the new Medium-term Management Plan is

marked

by a contraction of the domestic housing market due to a declining population, while the rental

housing and renovation markets look to see stable demand for the time being due to inheritance

planning and wealth effects. In the U.S. and Australian housing markets, although there are

concerns such as rising construction material prices, rising labor costs due to chronic labor

shortages, resurgence of inflation, and elevated interest rates, we expect solid demand due to a

chronic housing supply shortage compared to the growing populations.

In this business environment, we plan to achieve net sales of 3,220 billion yen and recurring

income of 280 billion yen in the fiscal year ending December 31, 2027, which is the final year

of the new Medium-term Management Plan. During the new Medium-term Management Plan period, we

will aim for an extremely high average annual EPS growth rate of 14.7%, and plan for ROE to

reach at least 15%, significantly exceeding the cost of equity of 7.4%.

Following on from the previous Medium-term Management Plan, we plan to continue to make

aggressive investments to achieve our Long-term Vision during the course of the new plan as

well. We plan to invest a total of 413 billion yen over the next three years in our

single-family homes business in the U.S. and Australia, which are driving our business growth,

our real estate development business focusing on multi-family housing and medium- to large-scale

wooden constructions, and the expansion of our wood building material manufacturing bases both

in Japan and overseas. By promoting further business expansion through aggressive investment, we

aim to achieve our Long-term Vision Mission TREEING 2030 ending in 2030. At the same time,

keeping in mind the results of the previous Medium-term Management Plan and our aggressive

investment plans for the future, we have raised our recurring income target for 2030, the final

year of the Long-term Vision, from 250 billion yen to 350 billion yen. We aim to increase

corporate value to the next level while expanding our management base both in Japan and

overseas.

Timber and Building Materials Business

As the number of new detached housing starts in Japan declines, it will be difficult to

achieve sustainable growth with a business model that relies on traditional intermediate

distribution margins, centered on the domestic residential construction market. The key is

to utilize domestic timber, which is abundant in stock, and to promote the use of wood in

the non-residential construction market. Specifically, we have launched the Kowa-no-mori

project in Iwaki City, Fukushima Prefecture, as our first timber industrial complex using

domestic timber. In this project, we aim to actively utilize domestic timber, mainly

Japanese cedar. We will also build an integrated business model that covers all processes

from manufacturing to sales, with an eye on the spread of medium- to large-scale wooden

constructions and the export market.

In addition, we will promote support services such as structural calculations and drawing

creation for contractors and builders through Home Express Structure Design, and will work

to create and materialize solution-based functions and services that increase the added

value of the Timber and Building Materials Business. This includes JUCORE Mitsumori and Home

Eco Logistics, which contribute to reducing the workload in the building materials

distribution and logistics industries, and One Click LCA, which visualizes CO2 emissions

during construction. Furthermore, using Teal Jones Louisiana Holdings LLC, a manufacturing

company in the U.S. that we plan to acquire as a new subsidiary, as a foothold, we will

establish a supply system for construction materials in the U.S. utilizing the abundant

plantation forest resources of southern yellow pine.

Housing Business

The anticipated decline in population and households in Japan is expected to result in a reduction of new housing starts. We will enhance the product appeal of Forest Selection, a semi-custom product tailored to customer requirements and competitively priced, as well as the single-story product GRAND LIFE, through significant cost reductions and data-driven marketing strategies. Simultaneously, we will enhance our initiatives for the Grand Estate Design Project targeting high-net-worth individuals. We will also steadily increase our market share by strengthening our land procurement system across the Group, including land proposals for first-time home buyers and securing land for the spec home business. We will rapidly advance digital transformation (DX), which involves digitizing the vast amount of real data accumulated to date, one of the Group's greatest assets, and using it as information to transform our operations. DX will also help us to fundamentally transform our operations and raise productivity through customer-oriented innovations. Furthermore, we will strengthen our business foundations in areas with room for growth, such as rental housing, spec homes, renovations, real estate brokerage, rental management, and greening.

Global Construction and Real Estate Business

We will continue to focus on the U.S. and Australia, as well as expand our real estate

development business in Asia and Europe, with emphasis on single-family homes and

multi-family housing developments. We will also promote medium- to large-scale wooden

constructions both in Japan and overseas.

The U.S. single-family homes market is expected to continue to face supply shortages for

the

time being in response to steadily growing demand. Leveraging the more than 80,000 lots that

have already secured and a stable procurement system, the Group will continue to work to

secure high-quality land, with the goal of doubling our current sales to 23,000 units per

year by 2030. In the short term, this business will be affected by factors such as mortgage

rates and the existing homes market, but in the medium to long term, steady growth is

expected against the backdrop of the supply-demand gap. We will continue to make careful and

proactive investments while also taking into consideration financial discipline in order to

expand the business. Furthermore, we will continue to expand our FITP business*4 in order to

address future labor shortages and strengthen profitability by stabilizing the supply chain.

We plan to expand our truss and panel plants from nine locations as of the end of the

previous fiscal year to more than 15 by 2027, and will also improve our construction project

coverage rate of the Group's housing companies and real estate development companies.

Our real estate development business in the U.S. focuses mainly on multi-family rental

housing and has been struggling in a tough capital market with interest rates remaining

elevated. On the other hand, occupancy rates and rent growth in multi-family rental housing

have been stable because of the supply shortage and affordability issues in single-family

homes. We will continue to carefully select and commercialize excellent projects while

closely monitoring interest rates and market trends. In addition, while global demand for

offices has yet to recover, as the construction industry accelerates efforts toward carbon

neutrality, demand for wooden offices using mass timber construction, one of our strengths,

is increasing. We will promote decarbonized, sustainable real estate development in the

U.S., Australia, Europe, and Japan.

Australia also continues to face a chronic shortage of housing supply caused by population

growth, and strong housing demand is expected to continue in the medium to long term. With

the acquisition of Metricon in 2024, our Australian single-family homes business now sells

more than 7,000 units per year, giving us a dominant top market share in the country. In

addition to increasing the number of units sold, our lineup of products has also been

expanded thanks to Metricon's extensive offerings. Going forward, we will aim to realize

synergies and improve profitability by leveraging economies of scale through joint

purchasing of materials, development of construction methods, integration of core systems,

and transformation of sales methods, with the aim of selling 10,000 units per year by 2030.

Environment and Resources Business

As global initiatives for carbon neutrality intensify, the demand for premium forest-derived carbon credits is increasing worldwide. Going forward, we will work to expand the area of responsibly managed forests both in Japan and overseas, with a view to establishing a second forestry fund, and to develop the foundations of sustainable forestry. At the same time, there is increasing growth potential not only for wood fuel for biomass power generation, but also for biorefineries used to make Sustainable Aviation Fuel (SAF),*6 an alternative to fossil fuels, and biodegradable plastics. Our objective is to cultivate competitive wood fuel for biomass power generation and optimize the value of wood resources, particularly in the biorefinery sector.

6 Sustainable Aviation Fuel (SAF) is produced primarily from waste cooking oil, microalgae, wood waste, sugarcane, wastepaper, amid other sources. SAF has a greater effect on reducing CO2 emissions than jet fuel made from fossil fuels (petroleum, etc.). (Reference: website of the Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry)Further integration of business operations and ESG

Governance-related initiatives

With regard to strategically held shareholdings, the Board of Directors regularly reviews

the returns on each individual stock and the status of transactions with the company to

confirm the rationality and necessity of these holdings. As of the end of the previous

fiscal year, the market value of these shares had fallen to around 8% of net assets, and we

will continue to reduce them while discussing the rationality of each holding. With regard

to the executive remuneration system, in line with the rise in profit levels, we have raised

the base profit, which is the basis for variable remuneration, from 100 billion yen to 150

billion yen. In addition, with regard to the performance-linked portion, which accounts for

15% of remuneration, previously the Company's stock price growth rate (two-thirds) and the

achievement rate of greenhouse gas emission reduction targets (one-third) were used, but

from the new Medium-term Management Plan, this has been changed to one-third stock price

growth rate and two-thirds greenhouse gas emission reduction target, strengthening our focus

on sustainability.

In addition, we will expand our employee stock ownership plan and introduce a new stock

compensation plan for employees to foster a sense of belonging to the Company and to raise

motivation among all executives and employees about business performance and rising stock

price.

Human resources strategy

To achieve the targets of our Long-term Vision Mission TREEING 2030, we need to further

globalize, venture into new business areas, and transform our existing businesses. To

achieve this, we need to continually secure, develop, and improve the engagement of the

right human resources, while also recognizing that it is essential to secure and develop

talent with the execution capability to create new businesses and transform existing

businesses.

For this reason, the Group has established three pillars for its human resources strategy:

namely, securing and developing human resources who will transform and create businesses, a

system to maximize employee performance and a free and open corporate culture, and promotion

of health management. Based on this, we aim to build an even stronger business foundation

through the synergistic effects of the various measures to advance these strategies. In

terms of organizational structure, we established the Corporate Division to oversee the Head

Office organizations in 2025 and build a system to support overseas business divisions by

promoting human resources development through planned personnel rotations, in order to raise

the overall level of our organizational capabilities.

In addition, as stated in the Sumitomo Forestry Group Declaration on Diversity, Equity and

Inclusion announced in 2024, all executives and employees will continue working to create a

workplace environment where everyone is respected, treated fairly, and accepted within the

organizational community.

Contributing to decarbonization and nature positivity

With the implementation of the Wood Cycle through its business activities, the Group is contributing to a decarbonized society by increasing the amount of CO2 absorbed by forests and promoting carbon sequestration over the long term through the wood products and wooden buildings made from them. In August 2018, we obtained certification for our SBT targets based on the standards at the time. Then, in November 2024, we established short-term targets for 2030 with the goal of achieving net zero emissions by 2050, and obtained new SBT certification. In addition to our efforts to decarbonize toward carbon neutrality, we will continue to accelerate our initiatives toward biodiversity and nature conservation and restoration, contributing to the realization of a nature-positive society.

In conclusion

Our Corporate Philosophy states: "The Sumitomo Forestry Group utilizes wood as a healthy and environmentally friendly natural resource to provide a diverse range of lifestyle-related services that contribute to the realization of a sustainable and prosperous society. All our efforts are based on Sumitomo's Business Spirit, which places prime importance on fairness and integrity for the good of society." As we enter a new stage, Mission TREEING 2030 Phase 2, we aim to achieve our Long-term Vision Mission TREEING 2030, by globally expanding the Wood Cycle, focusing on forests, wood, and construction. We will work with our stakeholders in Japan and overseas to achieve sustainable growth and the realization of a sustainable and prosperous society by maximizing the value of forests and trees.

Toshiro Mitsuyoshi

President and Representative Director

Toshiro Mitsuyoshi

President and Representative Director