- Home

- Sustainability

- Governance

- Corporate Governance

Corporate Governance

Basic Policy

The Sumitomo Forestry Group utilizes wood as a healthy and environmentally friendly natural resource to provide a diverse range of lifestyle-related services that contribute to the realization of a sustainable and prosperous society. All our efforts are based on Sumitomo's Business Spirit, which places prime importance on fairness and integrity for the good of society. Therefore, we strive to ensure management transparency, sound and legal business practices as well as rapid decision-making and business execution.

By further enhancing and strengthening its corporate governance through these efforts, the Company aims to continuously increase its corporate value and conduct management that lives up to expectations of various stakeholders around the Group.

- Click here for related information

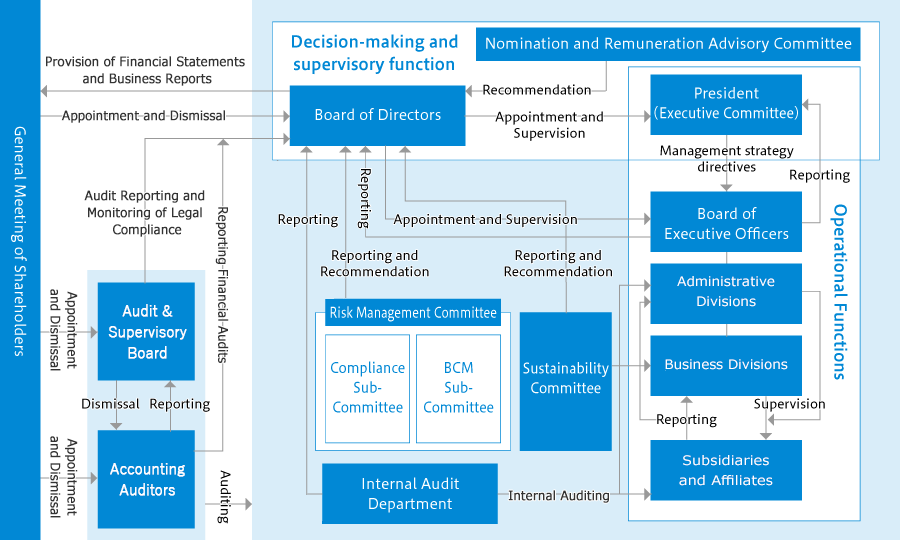

Corporate Governance and Internal Control

Sumitomo Forestry introduced the Executive Officer system to separate decision making and management oversight functions from operational execution functions. Comprised of ten Directors (eight male/80.0%, two female/20.0%) including four Outside Directors (two male, two female), the Board of Directors is structured to make quick decisions. The oversight function of the Board of Directors has been strengthened, the lines of operational responsibility clarified, and the Chairman of the Board of Directors no longer serves as an Executive Officer. The Nomination and Remuneration Advisory Committee has been established to provide opinion to the Board of Directors on selecting Director and Audit & Supervisory Board Member candidates and Executive Officers as well as determining compensation of Directors and Executive Officers, for the purpose of ensuring transparency and fairness of decision-making.

Composition of Directors (gender)*

| Male | Female | |

|---|---|---|

| Number (persons) | 8 | 2 |

| Ratio(%) | 80 | 20 |

*As of March 28, 2025

Composition of Directors (age group)*

| 50s | 60s | 70s | |

|---|---|---|---|

| Number (persons) | 2 | 5 | 3 |

| Ratio(%) | 20 | 50 | 30 |

*As of March 28, 2025

Sumitomo Forestry is a company with Audit & Supervisory Board. In addition to attending important meetings within the Company, the Audit & Supervisory Board Members conducts audits of the Directors' execution of duties, through sharing information and opinions with auditors at Group companies and the staff in the Internal Audit Division, and by supervising staff assisting auditing operations.

As of March 28, 2025, ten Directors (including four Outside Directors), five Audit & Supervisory Board Member (including three Outside Members) and 20 Executive Officers (including five persons concurrently serving as Directors) were appointed to the Company. The Company notified Tokyo Stock Exchange, Inc. of the designation of the four Outside Directors and three Outside Audit & Supervisory Board Members as independent Officers as required by its regulations.

- Click here for related information

Corporate Governance System

Board of Directors and Executive Committee

In principle, the Board of Directors meets once a month, making decisions and carrying out its supervisory function for important issues in accordance with its discussion standards. In addition to making decisions on all important items and confirming business results, it supervises the Directors' execution of their duties. Directors and Audit & Supervisory Board Members are required to maintain an attendance rate of 75% or higher as a general rule.

The Executive Committee, which is an advisory body for the President, holds meetings twice a month, before the Board of Directors meeting to ensure that there is sufficient prior discussion on important issues. It is attended by those Directors who also serve as Executive Officers, as well as the full-time Audit & Supervisory Board Members as a general principle.

The Company ensures prompt decision-making and separation of supervision and operational execution functions, for effective performance of the Board of Directors. In fiscal 2024, the Board of Directors meetings were held 15 times while Executive Committee meetings were held 26 times.

List of Directors

| Position*1 | Name | Responsibility and Significant Concurrent Positions*1 | Board of Directors*2 | |

|---|---|---|---|---|

| Attended Meetings (meetings) |

Attendance Rate (%) |

|||

| Representative Director,

Chairman of the Board |

Akira Ichikawa | Outside Director, Konica Minolta, Inc.,

Outside Director, Sumitomo Chemical Company, Limited |

15 | 100 |

| Representative Director,

President and Executive Officer |

Toshiro Mitsuyoshi | ― | 15 | 100 |

| Representative Director,

Executive Vice President |

Tatsumi Kawata |

Divisional Manager of Corporate Division,

Overseeing Lifestyle Service Division |

15 | 100 |

| Director,

Senior Managing Executive Officer |

Atsushi Kawamura |

Divisional Manager of Global Construction and Real Estate Division,

Overseeing Timber and Building Materials Division |

15 | 100 |

| Director,

Managing Executive Officer |

Ikuro Takahashi | Divisional Manager of Housing Division | 15 | 100 |

| Director,

Managing Executive Officer |

Nobuyuki Otani*3 |

Deputy Divisional Manager of Corporate Division (Head of Corporate Planning and Finance) ,

General Manager of Corporate Planning Department of Corporate Division, Overseeing Environment and Resources Division |

12 | 100 |

| Outside Director | Mitsue Kurihara |

Chairman, Representative Director of Value Management Institute, Inc.,

Outside Director of Chubu Electric Power Co., Ltd., Outside Director of Japan Finance Corporation, Outside Director (Audit & Supervisory Committee Member) of Mizuho Bank, Ltd. |

15 | 100 |

| Outside Director | Yuko Toyoda | Attorney at Law | 15 | 100 |

| Outside Director | Toshio Iwamoto*3 |

Outside Director of Daiwa Securities Group Inc.,

Outside Director of East Japan Railway Company, Outside Director of Isetan Mitsukoshi Holdings Ltd. |

12 | 100 |

| Outside Director | Kenji Sukeno*4 |

Chairman & Director of FUJIFILM Holdings Corporation,

Chairman & Director of FUJIFILM Corporation, Director of FUJIFILM Business Innovation Corporation, Outside Director of Isetan Mitsukoshi Holdings Ltd. |

- | - |

*1Position, responsibility and significant concurrent positions as of March 28, 2025

*2Attended meetings and the attendance rate to Board of Directors meetings are in fiscal 2024

*3Attended meetings and attendance rate of Board of Directors meetings are after appointment as a Director on March 28, 2024

*4Appointed on March 28, 2025

Structure of the Board of Directors

The Board of Directors is composed of 17 individuals in a structure built on expertise, such as knowledge, experience, skill, and diversity. Sumitomo Forestry considers diversity such as gender and nationality as well as expertise which includes those who have a wealth of experience and success in the operations of the Sumitomo Forestry Group, those who have a wealth of experience and success in business such as corporate management, industry and policy and those who have specializations such as law and accounting.

Officer Skill Matrix

The table below outlines the skills (expertise, experience) that the Company takes into special consideration for each of the Directors and Audit & Supervisory Board Members.

| Position | Corporate management | Resources, environment | Construction, real estate development | Global | Finance, accounting | Human resources development, DEI | Legal, risk management | IT/DX | Industrial policy | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Directors | Akira Ichikawa | Chairman of the Board, Representative Director | ● | ● | ● | ● | ● | ● | ● | ||

| Toshiro Mitsuyoshi | Representative Director, President, Executive Officer | ● | ● | ● | ● | ||||||

| Tatsumi Kawata | Representative Director, Executive Vice President | ● | ● | ● | ● | ● | ● | ● | |||

| Atsushi Kawamura | Director, Senior Managing Executive Officer | ● | ● | ● | ● | ||||||

| Ikuro Takahashi | Director, Managing Executive Officer | ● | ● | ||||||||

| Nobuyuki Otani | Director, Managing Executive Officer | ● | ● | ● | ● | ||||||

| Mitsue Kurihara | Outside Director | ● | ● | ● | ● | ● | |||||

| Yuko Toyoda | Outside Director | ● | ● | ||||||||

| Toshio Iwamoto | Outside Director | ● | ● | ● | ● | ||||||

| Kenji Sukeno | Outside Director | ● | ● | ● | ● | ● | |||||

| Audit & Supervisory Board Members | Toshio Kakumoto | Audit & Supervisory Board Member | ● | ● | |||||||

| Kazunari Hada | Audit & Supervisory Board Member | ● | ● | ||||||||

| Yoshimasa Tetsu | Outside Audit & Supervisory Board Member | ● | |||||||||

| Makoto Matsuo | Outside Audit & Supervisory Board Member | ● | ● | ||||||||

| Takashi Kawachi | Outside Audit & Supervisory Board Member | ● | ● | ● | |||||||

Reasons for selection of the skills

| Corporate management | The Company needs board members who have experience in corporate management to achieve further growth of existing businesses, which cover a wide variety of aspects of people’s lifestyles, such as forestry management, timber and building materials distribution and manufacturing, housing construction, etc. and to fulfill our long-term vision amidst a global movement toward decarbonization. |

| Resources/Environment | In our long-term vision, we have set out to enhance the value of "forests" and "trees" through sustainable forestry management. To promote the creation of new value from properly managed forests and the expansion of sustainable forests, and to steadily implement initiatives such as responding to the recommendations of the TCFD (Task Force on Climate-related Financial Disclosures) and TNFD (Task Force on Nature-related Financial Disclosures), as well as achieving our SBT-based greenhouse gas emissions reduction targets, the Company needs board members who have expertise and experience in resources and the environment. |

| Construction/Real estate development | The Company needs board members who have expertise and experience in construction and real estate development to establish an early and stable profit base for our medium- and large-scale wooden construction operations, as set out in our long-term vision and Medium-Term Management Plan, and to ensure that our real estate development operations contribute sustainably to the realization of the wood cycle. |

| Global | "Advancing globalization" is one of the business policies of our long-term vision. The Company needs board members who have global experience to promote the expansion of the business areas and scale of our overseas group operations. |

| Finance/Accounting | To execute strategic investments with an awareness of capital costs while maintaining financial soundness and achieving sustainable and steady profit growth, the Company needs board members who have expertise and experience in finance and accounting. |

| Human resource development/DEI | In our long-term vision, we have set out to enhance "value for people and society." To strengthen our ability to continually secure and develop talent capable of driving business transformation and innovation, and to foster a vibrant organizational culture that maximizes employee performance while promoting health and well-being, the Company needs board members who have expertise and experience in human resource development and DEI (diversity, equity, and inclusion). |

| Legal affairs/Risk management | The Company needs board members who have expertise and experience in legal affairs and risk management to create a corporate governance structure for sustainable growth and mid- to long-term improvement of corporate value, and to build a risk management system for the global growth of our business operations and other. |

| IT/DX | In our long-term vision, we have set out to enhance "value for the market economy." To renew our business foundation through IT and digitalization, drive operational reform and efficiency through digital transformation (DX), and strengthen the medium- to long-term competitiveness of our businesses by leveraging emerging IT technologies, the Company needs board members who have expertise and experience in IT and DX. |

| Industrial policy | In our long-term vision, we have set out to enhance "value for the market economy". The Company must create policy frameworks in relation to society and therefore needs board members who have knowledge of industrial policy to promote the value and market penetration of sustainable, decarbonization-contributing products and services. |

Nomination Procedure for Directors

Director candidates are selected at the Board of Directors from a pool of personnel with superior personality traits and acumen, and potential value to the Company through consultation with the Appointment and Remuneration Advisory Committee. Summaries of background and interlocking status of the Directors are available on the website.

- Click here for related information

Training for Directors

Sumitomo Forestry has established a provision on training for Directors, Audit & Supervisory Board Members, and Executive Officers in Article 15 of its Basic Policy on Corporate Governance. Under this policy, the Company provides information and training opportunities to Directors, Audit & Supervisory Board Members and Executive Officers both at the time of appointment and on an ongoing basis during their term of office. In fiscal 2024, we conducted training on constructive dialogue with shareholders.

- Click here for related information

Summary of Analysis/Evaluation and Results of Overall Effectiveness of the Board of Directors

1.Method of evaluation

Every year, the effectiveness of the Board of Directors is analyzed and evaluated. This fiscal year, through a self-evaluation and analysis using a survey submitted by each of the Directors and Audit & Supervisory Board Members (the method of response was anonymous with responses sent directly to an outside organization, which maintained anonymity) and an outside evaluation of the survey results. In addition, an evaluation was conducted based on the implementation status of the role of the Board of Directors as set out in the Company’s Basic Policy on Corporate Governance (hereinafter, current status) and an exchange of opinions with Directors and Audit & Supervisory Board Members.

2.Result of evaluation

- As a result of the evaluation described in 1., the Company believes that the Board of Directors is functioning effectively.

- In response to the issues identified in last year’s evaluation, efforts have been made to enhance the Board’s monitoring function by reviewing the standards for agenda items and narrowing down discussion points, thereby shortening the time spent on explanations and ensuring sufficient time for deliberation. We will continue working to further improve the efficiency of Board operations.

- Future challenges include the need for appropriate oversight to ensure that succession planning for future executive candidates is effective, as well as the need to enhance dialogue with shareholders (investors) by thoroughly feeding back the content of those dialogues and engaging more meaningfully with investors.

We will strive to further improve the effectiveness at Board of Directors meetings by continually working to heighten the level of discussion with awareness toward highlighted topics in the future.

Audit & Supervisory Board

The Audit & Supervisory Board meets to discuss and make decisions on important matters regarding audits. The five Members, including three Outside Members, utilize the deep insights and diverse perspectives they have acquired from their various business backgrounds to conduct audits of the Directors’ execution of duties. The Audit & Supervisory Board met 14 times during fiscal 2024.

The appropriate human resources are also appointed as Audit & Supervisory Board Member at our main subsidiaries for the purpose of improving the effectiveness of auditing and informational exchange at these companies. Meetings of Audit & Supervisory Board of the entire Group is convened between full-time Members of Sumitomo Forestry and Members of the main subsidiaries. This meeting was held six times in fiscal 2024.

Audit & Supervisory Board Members

| Position*1 | Name | Responsibility and Significant Concurrent Positions*1 | Board of Directors*2 | Audit & Supervisory Board*2 | ||

|---|---|---|---|---|---|---|

| Attended Meetings (meetings) |

Attendance Rate (%) |

Attended Meetings (meetings) |

Attendance Rate (%) |

|||

| Full-time Audit & Supervisory Board Member | Toshio Kakumoto | ― | 15 | 100 | 14 | 100 |

| Full-time Audit & Supervisory Board Member | Kazunari Hada*3 | ― | 12 | 100 | 10 | 100 |

| Outside Audit & Supervisory Board Member | Yoshimasa Tetsu | Certified Public Accountant | 15 | 100 | 14 | 100 |

| Outside Audit & Supervisory Board Member | Makoto Matsuo |

Attorney at Law

Outside Director of Taisho Pharmaceutical Holdings. Director of Rapidus Corporation |

15 | 100 | 14 | 100 |

| Outside Audit & Supervisory Board Member | Takashi Kawachi*3 | President of Japan Foundation for Regional Art-Activities,

Outside Audit & Supervisory Board Member of The Yomiuri Shimbun |

11 | 92 | 9 | 90 |

*1Position, responsibility and significant concurrent positions as of March 28, 2025

*2Attended meetings and the attendance rate to Board of Directors meetings and Audit & Supervisory Board meetings in fiscal 2024

*3Attendance record after appointment as a Audit & Supervisory Board Member on March 28, 2024

Outside Directors

In the selection procedure for Outside Directors and Audit & Supervisory Board Members, determinations are based on the following standards of independence and professional criteria.

(1) Criteria for independence

If none of the below criteria apply, an individual will be considered independent.

1.An executive of the Company

An Executive Officer, Operating Officer, Manager or other type of worker (hereinafter, executive) of the Company, its subsidiary or affiliate

2.Consultant and other

(ⅰ)An employee, partner or other type of worker of a financial auditing company that conducts financial audits for the Company or its subsidiary or is in charge of auditing the Company or its subsidiary.

(ⅱ)A lawyer, certified public accountant, tax attorney or other type of consultant who has received from the Company or its subsidiary outside of Director compensation an annual average of 10 million yen or more in money or other types of financial gain in the past three fiscal years.

(ⅲ)An employee, partner, associate or other type of worker of a law office, audit company, tax accountant office, consulting firm or other type of advisory firm that is a major transaction party to the Company or its subsidiary (has received from the Company or its subsidiary payment equivalent to 2% or more of average consolidated total revenues of the past three fiscal years).

3.Major shareholder (fiduciary owner)

An individual (or in the case of a corporate entity, an executive of that entity) who directly or indirectly owns at least 10% of the Company’s total voting rights.

4.Major shareholder (owner)

An executive of a corporate entity that the Company or its subsidiary owns at least 10% of their total voting rights.

5.Transaction parties

(ⅰ)Customers (major transaction parties): An individual (or in the case of a corporate entity, an executive of that entity) to whom our sales amount to that individual or corporate entity is 2% or more of the Company’s total consolidated revenues.

(ⅱ)Suppliers (major transaction parties of the Company): An individual (or in the case of a corporate entity, an executive of that entity) to whom our purchase amount from that individual or corporate entity is 2% or more of their c Company’s total consolidated revenues.

6.Lenders

Lenders who have lent the Company 2% or more of total consolidated assets (or in the case of a corporate entity, an executive of that entity).

7.Contribution recipients

An individual (or in the case of a corporate entity, an executive of that entity) that the Company or its subsidiary has contributed an average 10 million yen a year or 2% of total income, whichever is higher, over the past three fiscal years.

8.Family

A spouse or relative within the second degree of an individual who cannot be declared independent according to this standard (excluding persons of no importance*).

9.Past requirements

An individual for which item 1 within the past ten years, or item 2 or 7 within the past five years, applies.

10.Outside Director reciprocal appointments

An executive or full-time Audit & Supervisory Board Member of a company that has an Outside Director who is an Executive Director or full-time Audit & Supervisory Board Member of the Company or its subsidiary.

* Persons of no importance, in line with the independence standards stipulated by the Financial Instruments Exchange, is defined as follows

・For each company, an individual who is not an Executive Director, Operating Officer, Manager or General Manager level employee

・For advisory firms such as law offices, audit companies or other, an individual who is not the firm’s employee, partner or associate

Four of our current Outside Directors and three of our Outside Audit & Supervisory Board Members are considered independent based on the above list of independency criteria, not to pose a conflict of interest with general shareholders.

(2) Standards of Concurrent Board Positions

(ⅰ)

When concurrently acting as a Director or Audit & Supervisory Board Member of another publicly listed company, the number of concurrent positions will be follows:

(a) When serving as an Executive Director at another company exercising relevant execution of operations,

only one company other than this Company;

(b) In situations other than (a), up to four companies other than this Company.

(ii)Ensure attendance rate of at least 75% for the meetings of the Board of Directors or Audit & Supervisory Board.

Nomination and Remuneration Advisory Committee

To secure transparency and ensure fairness, the Board of Directors has established the Nomination and Remuneration Advisory Committee as an advisory body to call on for opinions regarding decisions on candidates of Director and Audit & Supervisory Board Member, Executive Officer appointments, Director, Audit & Supervisory Board Member and Executive Officer dismissals, Chief Executive Officer and Executive Officer evaluations, and Director and Executive Officer compensation. The Nomination and Remuneration Advisory Committee is composed of the Chairman, the President and all Outside Officers (four Officers Directors and three Outside Audit & Supervisory Board Members), and a majority of the committee members are Outside Officers and one of the Outside Directors serves as the committee chairperson.

The Board of Directors determines the Directors’ remunerations within the amount specified by resolution of the General Meeting of Shareholders, taking into consideration the opinions stated by the Nomination and Remuneration Advisory Committee. The remunerations of Executive Officers are determined by the Board of Directors, taking into consideration the opinions of the Nomination and Remuneration Advisory Committee.

List of Nomination and Remuneration Advisory Committee Members

| Position*1 | Name | Nomination and Remuneration Advisory Committee*2 | ||

|---|---|---|---|---|

| Attended Meetings (meetings) | Attendance Rate (%) | |||

| Committee chairperson | Outside Director | Izumi Yamashita | 4 | 100 |

| Board Member | Outside Director | Mitsue Kurihara | 4 | 100 |

| Outside Director | Yuko Toyoda | 4 | 100 | |

| Outside Director | Toshio Iwamoto*3 | 2 | 100 | |

| Outside Audit & Supervisory Board Member | Yoshimasa Tetsu | 4 | 100 | |

| Outside Audit & Supervisory Board Member | Makoto Matsuo | 4 | 100 | |

| Outside Audit & Supervisory Board Member | Takashi Kawachi*3 | 2 | 100 | |

| Chairman of the Board and Representative Director | Akira Ichikawa | 4 | 100 | |

| Representative Director, President and Representative Director | Toshiro Mitsuyoshi | 4 | 100 | |

*1The position as of March 28, 2025

*2Attended meetings and the attendance rate to Nomination and Remuneration Advisory Committee meetings in fiscal 2024

*3Attendance record after appointment as Director on March 28, 2024

Risk Management Committee

Information regarding the Risk Management Committee is found in "Risk Management/ Risk Management Framework".

In fiscal 2024, Risk Management Committee was held four times, Compliance Subcommittee was held twice, BCM Subcommittee was held twice, and reports were made four times to Board of Directors respectively.

- Click here for related information

Sustainability Committee

In response to matters including climate change, SDGs and human rights issues, the Sustainability Committee was established in fiscal 2018 based on the growing requirements for medium to long-term initiatives and informational disclosure about the Environment, Society and Governance (ESG).

The Sustainability Committee is made up of Executive Officers also appointed as Director, and Divisional Mangers with the President acting as the Committee chairperson. The Committee formulates and promotes strategies for the Group’s medium to long-term sustainability challenges including climate change and nature-related matters, manages the progress of the Mid-Term Sustainability Targets including analysis of risks and opportunities, and monitors the implementation and effectiveness of the Our Values and Code of Conduct. Furthermore, from January 2024, the Sustainability Committee increased the number of times it meets annually from four to six in order to advance initiatives to address quality control and worker safety initiatives.

The content of all committee proceedings is reported to the Board of Directors to enable our business operations to become part of the solution for social issues.

- Click here for related information

Internal Audits

Sumitomo Forestry's Internal Audit Department draws on risk assessments in selecting about 60 business sites from among the roughly 200 business sites in the Group every year to conduct internal audits. Our staff members hold internal auditor qualifications certified by the Institute of Internal Auditors Japan, and there is also a Certified Internal Auditor (CIA). The sites are selected by specifying an order of priority based on the two perspectives of operational risk (business results, size, complexity of business, etc.) and control risk (risk management framework). In principle, the assessment will be conducted by visiting the site, interviewing the parties concerned, and checking the actual documents and other items. We are also promoting digital transformation (DX), including the introduction of AI tools for auditing.

In the internal audits, the department checks on how a business site is executing its operations and managing its office work, including its compliance with laws and regulations, and it reports its findings to the President, the Divisional Manager of the Corporate Division, and to Audit & Supervisory Board Members, as well as to the Manager responsible for the business site and the Executive Officer or Director in charge of the business site. Furthermore, if any indications have been made, the department checks the improvement efforts implemented at the business site, such as by examining documents and conducting quarterly follow-up reviews. Furthermore, plans and results regarding internal audits are reported directly to the Board of Directors, and a discussion session with Outside Officers has been held at least once a year regarding internal audits.

- Click here for related information

Executive Remuneration

In accordance with laws and regulations, Sumitomo Forestry discloses the remuneration paid to Officers (Directors and Audit & Supervisory Board Members) each fiscal year.

Total Remuneration Paid to Directors and Audit & Supervisory Board Members

(Fiscal 2024)

| Classification | Total amount of remuneration and other | Monthly remuneration | Performance-based remuneration (bonus) |

Non-monetary remuneration (performance-based restricted stock remuneration) |

Number of eligible Officers |

|---|---|---|---|---|---|

| Directors (excluding Outside Directors) |

¥million 530 |

¥million 271 |

¥million 168 |

¥million 92 |

7 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

53 | 53 | - | - | 3 |

| Outside Directors | 52 | 52 | - | - | 4 |

| Outside Audit & Supervisory Board Members | 35 | 35 | - | - | 4 |

*1 Names and amounts of Officers whose remuneration is greater than or equal to 1 billion yen are disclosed in Financial Statements

*2 The above number of eligible Directors of remuneration includes one Director and two Audit & Supervisory Board Members (including one Outside Audit & Supervisory Board Member) who retired at the close of the 84th Ordinary General Meeting of Shareholders held on March 28, 2024

*3 The performance indicator selected as the basis for calculating bonuses, which are performance-linked compensation, is core operating profit. The result for the fiscal year was ¥157.3 billion

*4 The amount of non-monetary compensation recorded for this fiscal year includes ¥15 million in adjustments based on the degree of achievement of performance evaluation indicators—such as the market capitalization growth rate—for fiscal 2022 and 2023, which fall within the period covered by the Medium-Term Management Plan (three years from January 1, 2022, to December 31, 2024). Of this amount, the achievement rate for remuneration linked to the market capitalization growth rate was 170.1%, resulting in the maximum payout rate of 120%. For remuneration linked to the sustainability index achievement rate, the reduction in greenhouse gas emissions was -40.1% compared to fiscal 2017, resulting in the maximum payout rate of 100%

- Click here for related information

Executive Remuneration

- The remuneration plan should be highly linked not only to short-term performance but also to medium- to long-term performance and improvement of corporate value;

- The plan should be linked to the value to be newly created and provided in the course of promoting the sustainability integrated management;

- The plan should be designed to be linked to the shareholder value of the Company;

- The remuneration level should be such that the Company can secure and maintain the human resources necessary to achieve its long-term vision; and

- The plan should ensure transparency and objectivity in the remuneration determination process.

- <Fixed remuneration>

- The Company will determine the amount of fixed remuneration for each position of Director in accordance with their responsibilities and roles. The fixed remuneration will be monthly, and a fixed amount will be paid in cash on a fixed date of each month.

- The amount of remuneration for Outside Directors, consisting only of monthly remuneration as fixed remuneration, will be determined in accordance with their responsibilities and roles.

- <Annual performance-based bonus>

- The amount of annual performance-based bonus will be judged comprehensively and determined by multiplying the standard bonus amount stipulated for each position with a payout ratio that fluctuates (lower limit 0%~upper limit 180%) in proportion to the base profit for each business year (the amount obtained by deducting actuarial differences regarding employees’ retirement benefit obligation and net income attributable to non-controlling interests from consolidated recurring income for the relevant fiscal year).

- The Company has adopted the method of amortizing actuarial differences regarding employees’ retirement benefit obligation as a lump sum in a single business year. Accordingly, any significant fluctuation in actuarial differences due to stock price fluctuations, interest rate conditions, or other at the end of the business year will have a significant impact on business performance. Therefore, to calculate base profit, the Company uses consolidated recurring income after deducting actuarial differences regarding employees’ retirement benefit obligation.

- Payment of annual performance-based bonus to each eligible Director will be decided upon by the Board of Directors taking into consideration the opinions of the Nomination and Remuneration Advisory Committee, which is chaired by an Outside Director and in which a majority of its members are Outside Officers.

- <Performance-based restricted stock remuneration>

-

Performance-based restricted stock remuneration is structured to reflect the Company’s performance during each period (three years) of the Medium-Term Management Plan. The standard stock remuneration amount prescribed for each position consists of (i) a portion linked to the growth rate of the Company’s market capitalization relative to TOPIX (two-thirds of the standard stock remuneration amount by position), and (ii) a portion linked to the achievement rate of SBT (Science Based Targets) greenhouse gas emission reduction targets (one-third of the standard stock remuneration amount by position), each during the relevant period.

To promote management that emphasizes medium- to long-term enhancement of shareholder value, performance-based restricted stock remuneration is a plan to grant restricted stocks to eligible Directors after the final fiscal year of the three-year Medium-Term Management Plan as an incentive to increase corporate value during the period of the Medium-Term Management Plan, in accordance with the achievement status of the Medium-Term Management Plan. The applicable period of the plan is the three years from January 1, 2022 to December 31, 2024 (hereinafter, the applicable period).

The amount of performance-based restricted stock remuneration is calculated using two indices and the method for calculation is as follows.

Remuneration linked to market capitalization growth rate

The aim of this system is to compare the Company’s market capitalization growth rate with the TOPIX growth rate to objectively measure and reflect the Company’s relative stock market valuation in the remuneration amount.

<Calculation formula> Amount equivalent to two-thirds of the standard stock compensation amount by position x payout ratio (growth rate of Company’s market capitalization during the period of the Medium-Term Management Plan/TOPIX growth rate during the same period)**The payout ratio range will be from 0% (lower limit) to 120% (upper limit)

Remuneration linked to sustainability indices achievement rate

By setting a payout ratio upper limit of 100%, if the Company fails to achieve its SBT (Science Based Targets*1) greenhouse gas emission reduction targets*2, the amount of remuneration will be reduced from the standard stock remuneration amount in accordance with the status of target achievement, thereby creating a strong incentive to achieve the targets.

<Calculation formula> One-third of the standard stock remuneration amount by position x payout ratio (percentage of achievement of Medium-Term Management Plan SBT greenhouse gas emission reduction targets).*3*1Refers to the emission reduction targets set by companies and to be achieved in five to fifteen years to comply with the level required by the Paris Agreement that was adopted at the 21st Session of the Conference of the Parties to the United Nations Framework Convention on Climate Change (COP21) and took effect in 2016 (which sets a goal of limiting global warming to well below 2℃ above pre-industrial levels and pursuing efforts to limit the increase to 1.5℃)

*2The emission reduction target for the initial coverage period has been set at –21.7% compared to the Company’s figures in fiscal 2017. Due to the revision of the SBT guidance requiring target resetting every five years, the target has been reset to a 20.8% reduction compared to fiscal 2021

*3The payout ratio range will be from 0% (lower limit) to 100% (upper limit)

- The stock remuneration amount to be paid to each eligible Director will be determined by the Board of Directors after the end of the subject period by calculating the cumulative amount of stock remuneration during the subject period based on the actual value of each evaluation index and considering the views of the Nomination and Remuneration Advisory Committee.

[Remuneration for Directors]

1. Basic policies

The remuneration of Directors of the Company is designed in accordance with the following policies:

2. Remuneration level

From the perspective of ensuring objectivity and appropriateness of the executive remuneration, the level of remuneration for Directors of the Company will be set with reference to the levels of other companies as surveyed by outside professional organizations, with the aim of achieving the mid-to-high level of remuneration in companies of similar size. The Company will revise the remuneration levels as necessary in response to changes in the external environment.

3. Composition of remuneration

Renumeration for Directors of the Company is composed of three types: (i) fixed remuneration commensurate with the Director’s responsibilities and roles, (ii) annual performance-based bonus as a short-term incentive, and (iii) performance-based restricted stock remuneration as a medium- to long-term incentive. Thus, the remuneration plan is designed to encourage management efforts from a short-term, and medium- to long-term perspective and to appropriately reward the results of such efforts. Remuneration for Outside Directors, who are responsible for management supervision from an independent standpoint and not in a position to execute business, is composed solely of fixed remuneration.

A summary of each type of remuneration is as follows:

4. Remuneration composition ratio

The plan has been designed so that the ratio of fixed remuneration to variable remuneration for Directors should be 60 to 40 when the base profit is 100 billion yen. Specifically, fixed remuneration accounts for 60%, annual performance-based Bonus (variable) accounts for 25%, and performance-based restricted stock remuneration (variable) accounts for 15% of the total remuneration, respectively. The remuneration for Outside Directors consists solely of fixed remuneration.

5. Remuneration governance

The matters regarding executive remuneration, such as the amount of individual remuneration for Directors, will be determined by the Board of Directors taking into account the views of the Nomination and Remuneration Advisory Committee chaired by an Outside Director, in which Outside Officers constitute a majority.

6. Forfeiture of remuneration

If the Board of Directors confirms any wrongdoing or other misconduct by a Director, the Company may demand a payment restriction or return of the performance-based restricted stock remuneration paid to such Director.

[Remuneration for Audit & Supervisory Board Member ]

Compensation for Audit & Supervisory Board Member consists only of monthly compensation as basic compensation. In addition, we use results of a survey conducted by a third party for directorship remuneration at domestic corporations in order to set an appropriate remuneration level from the perspective of ensuring objectivity and appropriateness of executive remuneration.

- Click here for related information

Strategically-held Shares

Article 5 of Sumitomo Forestry's Basic Policy on Corporate Governance cross-shareholding is as follows.

1.The Company may acquire and hold shares in its business partners and counterparties when the Company determines that such shareholdings will contribute to mid- to long-term enhancement of the Company’s corporate value from the perspective of, among others, maintenance and reinforcement of long-term and stable business relationships with those partners and counterparties as well as expansion of the Company’s business as a result of such closer ties with those parties.

2.At meetings of the Board of Directors, the Company will regularly examine whether the holdings of the shares under the preceding paragraph (the "Strategically-held Shares") lead to the improvement of its corporate value through analyzing the relationship between the profits/risks associated with such holdings and the cost of capital, and will verify the purpose and rationale of such holdings. When the Company judges that the rationale and necessity of such holdings cannot be confirmed, it will reduce the number of such Strategically-held Shares.

3.The Company will appropriately exercise its voting rights pertaining to the Strategically-held Shares in accordance with its voting criteria and based on its comprehensive judgment from the perspective of the improvement of its corporate value.

- Click here for related information

- Home

- Sustainability

- Governance

- Corporate Governance