- Home

- Sustainability

- Governance

- Return to Shareholders and IR Activities

Return to Shareholders and IR Activities

Basic Policy

In recent years, institutional investors have shifted the way to evaluate a company. Among these, engagement is considered important. The dialogue between companies and their shareholders as well as investors is growing in terms of strategies and efforts to improve corporate value. Trends to promote even broader engagement are growing after the publishing of the Stewardship Code even in Japan.

The Sumitomo Forestry Group places great importance on engagement from the perspectives of properly assessing the corporate value and earning trust from the market. The Group discloses a wide range of information, including non-financial information, in a timely and transparent manner to facilitate understanding among stakeholders of our management policies and business strategies, while regularly escalating the opinions and requirements of our important stakeholders, such as investors, to the management, reflecting them to our measures towards sustainable growth.

Returns to Shareholders

Basic Policy on Returns to Shareholders and Retained Earnings

Acknowledging that providing returns to shareholders is one of its most important tasks, Sumitomo Forestry has adopted a basic policy of paying stable and continuous returns.

Going forward, in addition to improving return on equity (ROE) and enhancing shareholders' equity by making good use of retained earnings for effective investment and research and development activities that help improve long-term corporate value, Sumitomo Forestry will continue to pay an appropriate level of shareholder returns in line with earnings while reflecting an overall balanced consideration of factors such as business fundamentals, financial conditions and cash flow.

Dividends in the Fiscal Year Ended December 31, 2024

In the fiscal year ended December 31, 2024, a year-end dividend of 80 yen per share and an interim dividend of 65 yen per share were issued. This corresponds to a full-year dividend of 145 yen per share.

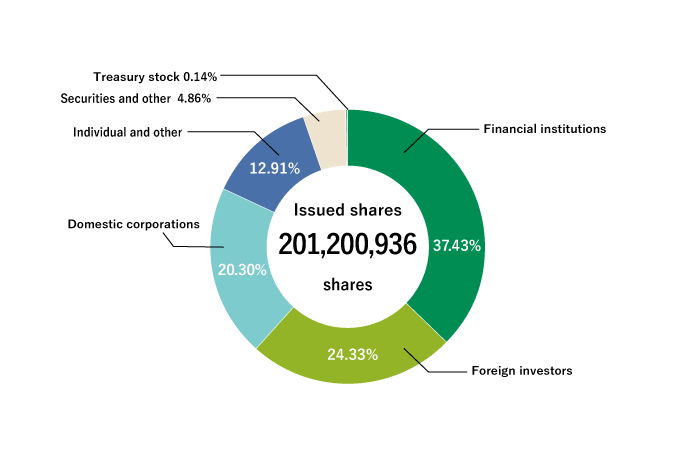

Share Distribution by Shareholder Type (As of December 31, 2024)

* Digits below unit values displayed are cutoff on the chart

Information Disclosure and Communication

Basic Policy on Information Disclosure and Communication

In the interest of greater management transparency, Sumitomo Forestry takes a proactive approach to information disclosure.

We strive to provide reporting and explanations in an easy-to-understand manner at the General Meeting of Shareholders. We also publish various IR information in Japanese and English on our website including financial information such as short financial statements, fact book and a summary of financial results and forecasts, and housing business information such as monthly order reports. In addition, we also publish detailed information about sustainability initiatives in Japanese and English on our website.

Furthermore, News releases share the latest information about Sumitomo Forestry Group with stakeholders. Sumitomo Forestry published 72 news releases in fiscal 2024.

We have been publishing the Integrated Report since fiscal 2017 in order to strengthen our communication on the Group’s initiatives to improve corporate value from both financial aspect and sustainability-related non-financial aspect. Besides the integrated report and the Japanese language report for shareholders on business activities, we also strive to actively provide information that includes the publishing of notifications for our Ordinary General Meeting of Shareholders in both English and Japanese in print and online forms.

- Click here for related information

Integrated Report 2024

Japanese reports for shareholders on business activities (second quarter)

Two-Way Communication with Shareholders and Investors

- Click here for related information

General Meeting of Shareholders

Through various initiatives, we endeavor to get as many shareholders as possible to participate at the meetings and exercise their right to vote. These initiatives include sending out and posting online convocation notices (in Japanese and English) earlier than legally required deadline and accommodating shareholders who wish to cast their votes electronically (online, etc.).

Individual Meetings

Sumitomo Forestry holds individual meetings with security analysts and institutional investors following the announcement of its quarterly results. In fiscal 2024, we conducted a total of 478 consultations in Japan and overseas. In addition, we held small meetings between analysts and the President, as well as on-site briefings at model homes for our custom-built detached housing business in Japan. We will continue to hold small meetings and on-site briefings accordingly.

IR Informative Meetings for Individual Investors

Sumitomo Forestry holds regular IR informative meetings for individual investors. In November 2024, we held one IR informative meetings for individual investors online. During these meetings, we explained about the Sumitomo Forestry Group’s history and business lines, in addition to our long-term vision. Meetings were concluded with a Q&A session.

IR Activities for Overseas Institutional Investors and Shareholders

Sumitomo Forestry management team held online conferences with institutional investors and shareholders in the United States, Europe, Asia, and other regions in fiscal 2024, in addition to engaging in efforts such as the distribution of English versions of financial information to all of our institutional investors and shareholders overseas. In Europe, we held an overseas roadshow to explain our business performance and business strategies, and exchanged ideas.

We also participate in domestic and international conferences held by stock brokerage firms to have even more opportunities for dialogues.

Initiatives in Sustainable Finance

Conclusion of Positive Impact Financing Agreement

In December 2024, Sumitomo Forestry entered into a loan agreement under a syndicated*1 Positive Impact Finance arrangement (a type of business loan that does not specify the use of funds), with Sumitomo Mitsui Trust Bank, Limited serving as arranger. This agreement was concluded based on a "Positive Impact Assessment" in accordance with the United Nations Environmental Programme Finance Initiative*2 Principles for Positive Impact Finance*3 and the "Model Framework for Financial Products for Corporates with unspecified use of funds." The assessment recognized Sumitomo Forestry’s contribution to the SDGs through its wood-centered value chain, the "Wood Cycle." In concluding this agreement, Sumitomo Forestry obtained a third-party opinion*4 from Japan Credit Rating Agency, Ltd. regarding the alignment with the Principles for Positive Impact Finance and the model framework, as well as the validity of the assessment indicators used.

Through this agreement, Sumitomo Forestry also aims to improve medium-to long-term corporate value by further enhancing initiatives to achieve the SDGs.

*1A financing method in which multiple financial institutions form a syndicate to provide loans under a single agreement and on the same terms

*2UNEP FI established the Principles for Positive Impact Finance in January 2017. Companies disclose their contributions toward achieving the SDGs and banking institutions evaluate the positive impact and provide capital in an effort to maximize the positive impact and minimize the negative impact of corporate entities. The banking institutions providing the financing take responsibility to monitor the indicators and verify ongoing positive impact. The United Nations Environment Programme (UNEP) is a subsidiary body of the United Nations established in 1972 as an implementing agency for the Declaration of the United Nations Conference on the Human Environment and the International Environment Action Programme. UNEP FI is a broad and close partnership between UNEP and more than 200 global financial institutions. Since its establishment in 1992, it has been working with financial institutions, policies, and regulators to transform itself into a financial system that integrates economic development with environmental, social and governance (ESG) considerations

*3This is a financial framework for achieving the Sustainable Development Goals (SDGs) formulated by the United Nations Environment Programme Finance Initiative (UNEP FI) in January 2017. By disclosing contributions to the achievement of SDGs, with banks assessing the positive impact of these contributions and providing funds, the framework guides the efforts of fund providers to increase positive impacts and reduce negative impacts. As the responsible financial institution, lending banks monitor indicators to ensure that their impacts are continuing

*4For details on the third-party opinion, please refer to related information

- Click here for related information

Conclusion of Sustainability Linked Loan

In August 2022, we concluded a sustainability linked loan with Sumitomo Mitsui Banking Corporation. Sustainability linked loans set sustainability performance targets ("SPTs") based on the borrower's management strategy, and promote environmentally and socially sustainable economic growth by aligning borrowing terms with actual progress of SPTs. By aiming to achieve the SPTs set in the loan agreement, we will promote sustainable management.

The SPTs in this case adopt a climate change score by which CDP, an international NGO, evaluates the greenhouse gases emission reduction activity and the action of the climate change mitigation measures.

In 2024, two similar financing agreements were concluded. We will continue to actively exchange information with financial institutions.

- Home

- Sustainability

- Governance

- Return to Shareholders and IR Activities