- Home

- Sustainability Report

- Environment

- Responding to TCFD and TNFD

Responding to TCFD and TNFD

Express Its Support of the TCFD and TNFD

Changes in the natural environment, such as climate change and biodiversity, affect the Sumitomo Forestry Group's performance in various ways because its business focuses on forests and trees. For this reason, the Sumitomo Forestry Group has been among the first to respond to the recommendations of international initiatives such as the Task Force on Climate-related Financial Disclosure (TCFD) and Task Force on Nature-related Financial Disclosure (TNFD).

In response to the TCFD recommendations of 2017, the Sumitomo Forestry Group expressed its support for the recommendations in July 2018, and conducted its first TCFD scenario analysis in September 2018 as part of a project supported by Japan's Ministry of the Environment.

On the other hand, as for the TNFD, it took more than two years from the call for its launch at the G7 Environment Ministers' Meeting in May 2019 to the official establishment of the Task Force and Forum. After v0.1 of the TNFD framework beta version was released in March 2022, v0.3 was released in November 2022, reflecting user feedback. Sumitomo Forestry utilized v0.3 to conduct a trial analysis in the area of timber procurement, where the Group has accumulated the most data, and disclosed the results in its Sustainability Report 2023 released in April 2023. In December 2023, after the final recommendations (v1.0) were released by TNFD in September 2023, we announced that we had become an early adopter to the recommendations.

Our response to TCFD and TNFD (chronological timeline)

| TNFD | Developments around the world | TNFD |

|---|---|---|

|

2017 Jun. TCFD announced its recommendations |

||

|

2018 Jul. Expressed its support of the TCFD recommendations Sept. Conducted its first TCFD scenario analysis Covered the following two divisions Timber and Building Materials Business Division Housing Division |

||

|

2019 Jul. First disclosure of information based on the TCFD recommendations in the Sustainability Report, etc. |

||

|

2021 Oct. Conducted its second TCFD scenario analysis Covered the following two divisions Environment and Resources Division Global Housing and Real Estate Business Division |

2021 Jun. TNFD was established |

|

|

2022 May. Compiled and disclosed the results of its second TCFD scenario analysis |

2022 Mar. TNFD released its beta version v0.1 |

2022 Feb. Participated in TNFD Forum |

|

Sept.

Conducted its third TCFD scenario analysis

Conducted covering all businesses within the Group |

Nov. TNFD released its beta version v0.3 | Dec. Conducted trial LEAP analysis based on the TNFD framework beta version v0.3 |

|

2023 Apr. Compiled and disclosed the results of its TCFD scenario analysis |

2023 Sept. TNFD announced its final recommendations |

2023 Apr. Disclosed results of its TNFD analysis Dec. Became a TNFD Early Adopter Conducted TNFD LEAP analyses |

|

2024 Jan. TNFD announces the Early Adopter program at the WEF in Davos |

2024 Apr. Compiled and disclosed the results of its TNFD LEAP analyses |

2024

- Incorporate the results of TCFD scenario analysis and TNFD LEAP analysis into the next Mid-Term Management Plan Mission TREEING 2030 Phase 2 (2025-2027)

2025 and beyond

- Start of Mid-Term Management Plan “Mission TREEING 2030 Phase 2 (2025-2027)

- Management of KPI progress

- Expansion and deepening of the scope of analysis for TCFD scenario analysis and TNFD LEAP analysis

In preparing this report, we have referred to the disclosure recommendations in the TCFD and TNFD recommendations and have made every effort to disclose information in all areas.

Recommended disclosure items in the TCFD and TNFD recommendations

| Governance | Strategy | (C) Risk Management

(N) Management of Risks and Their Impacts |

Metrics and Targets |

|---|---|---|---|

| Disclose the organization’s governance around climate-related risks and opportunities, nature-related dependencies, impacts, and risks and opportunities | Disclose the effects of climate-related risks and opportunities as well as nature-related dependencies, impacts, risks and opportunities on the organization’s business model, strategy and financial planning where such information is material | Describe the processes used by the organization to identify, assess, prioritize and monitor climate-related risks as well as nature-related dependencies, impacts, risks and opportunities | Disclose the metrics and targets used to assess and manage climate-related risks and opportunities as well as assess and manage material nature-related dependencies, impacts, risks and opportunities |

| Recommended Disclosures | Recommended Disclosures | Recommended Disclosures | Recommended Disclosures |

|---|---|---|---|

| A. Describe the board's oversight of climate-related risks and opportunities, and nature-related dependencies, impacts, risks and opportunities

B. Describe management’s role in assessing and managing climate-related risks and opportunities, and managing nature-related dependencies, impacts, risks and opportunities C. (N) Describe the organization’s human rights policies and engagement activities, and oversight by the board and management, with respect to Indigenous Peoples, Local Communities, affected and other stakeholders, in the organization’s assessment of, and response to, nature-related dependencies, impacts, risks and opportunities |

A. Describe the climate-related risks and opportunities as well as nature-related dependencies, impacts, risks and opportunities the organization has identified over the short, medium and long term

B. Describe the effect climate-related risks and opportunities as well as nature-related dependencies, impacts, risks and opportunities have had on the organization’s business model (N), value chain, strategy and financial planning, (N) as well as any transition plans or analysis in place C. Describe the resilience of the organization's strategy to climate-related and nature-related risks and opportunities, considering different scenarios. (C) Scenarios include scenarios below 2°C D. (N) Disclose the locations of assets and/or activities in the organization’s direct operations and, where possible, upstream and downstream value chain(s) that meet the criteria for priority locations |

A. (C) Describe the organization's process for identifying and assessing climate-related risks

(N) Describe the organization's process for identifying, assessing, and prioritizing nature-related dependencies, impacts, risks, and opportunities in direct operations (N) Describe the organization's process for identifying, assessing and prioritizing nature-related dependencies, impacts, risks and opportunities in upstream and downstream value chains B. Describe the organization's processes for managing climate-related risks as well as nature-related dependencies, impacts, risks and opportunities C. Describe how the processes for identifying, assessing, and managing climate-related and nature-related risks is integrated into the organization's overall risk management |

A. Disclose the metrics used by the organization to assess and manage climate-related and nature-related risks and opportunities in line with its strategy and risk management process

B. (C) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks (N) Disclose the metrics used by the organization to assess and manage its dependence and impacts on nature C. Describe climate-related risks and opportunities and the targets and objectives used by the organization to manage nature-related dependencies, impacts, risks, and opportunities, and the organization's performance relative to them |

*Created by integrating the disclosure items listed in the TCFD and TNFD recommendations.

*For items that cannot be integrated, recommended disclosures only in the TCFD recommendations are indicated by (C), and items recommended for disclosure only in the TNFD recommendations are indicated by (N).

Governance

The Sumitomo Forestry Group responds to climate change and nature related issues primarily at the Sustainability Committee, chaired by the President and composed of members made up of board of directors concurrently serve as executive officers and each divisional head. The Sustainability Committee analyze risks and opportunities of medium to long-term ESG issues related to sustainability of the Sumitomo Forestry Group and formulates and promotes measures and initiatives. The committee members also oversee progress management of the Mid-Term Sustainability Targets, which incorporate business strategies toward achieving the SDGs, monitor implementation and effectiveness of the “Our Values” and Sumitomo Forestry Group Code of Conduct. All activities at committee meetings are reported to the Board of Directors, which are then reflected in business execution.

The Sumitomo Forestry Group Human Rights Policy, formulated in accordance with international standards such as the United Nations Guiding Principles on Business and Human Rights, sets forth the Group's commitment to respect the human rights of all people involved in its business operations, including indigenous peoples, local communities, affected stakeholders, and other stakeholders, which represents a priority in its efforts to address nature-related issues. Similarly, the Sustainability Committee manages the situation in terms of human rights, and reports to the Board of Directors.

In February 2022, we made partial revisions to our executive compensation system to further integrate our business and ESG, and introduced compensation linked to the achievement rate of sustainability indicators. A system, where in the event that Sumitomo Forestry fails to meet its long-term targets for greenhouse gases emissions reduction certified as Science Based Targets (SBT), the amount of remuneration paid will be reduced from the regular stock remuneration amount in accordance with the degree of target performance. Under Mission TREEING 2030, our long-term vision announced at the same time, we created the three-year Mission TREEING 2030 Phase 1 (2022 -2024) of Medium-Term Management Plan, along with the Mid-Term Sustainability Targets, the progress of which we are managing.

- Click here for related information

Strategy

The Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) states unequivocally that human activity is warming the air, seas and land, causing extreme weather and increases the frequency of occurrence, and that greenhouse gases emissions are strongly related to changes in ice sheets and sea levels. In addition, according to the report Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, published by the World Economic Forum in January 2020, more than half of the world's GDP, or 44 trillion US dollars, is nature itself or the services it provides, and loss of nature has a particularly large impact on the agriculture, forestry, fisheries, and construction industries. The international community has proposed the concept of “Nature Positive,” which calls for halting the loss of nature or reversing it by 2030, compared to 2020, and fully restoring it by 2050.

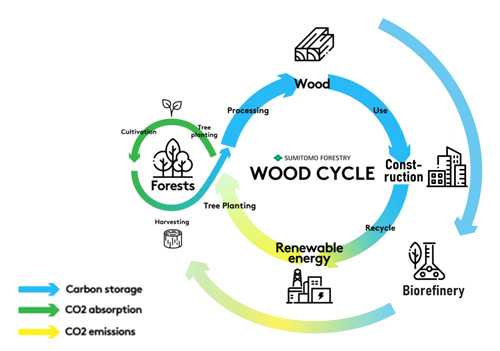

Against this backdrop, society's expectations for the role of forests in absorbing CO2 and fixing carbon and providing ecosystem services, timber and wood products supplied from sustainable forests, carbon fixation and reduction of greenhouse gas emissions through wooden buildings, and the use of unused forest resources as biomass fuel are increasing.

In February 2022, we announced Mission TREEING 2030, our long-term vision that incorporates our business concept behind the Sumitomo Forestry Group's ideal vision for 2030, which is also the target year of the SDGs. Mission TREEING 2030 sets out the following four strategies as our business policy: 1. Maximizing the value of forests and the wood to create decarbonization and create a circular bioeconomy; 2. Advancing globalization; 3. Striving for transformation and the creation of new value; and 4. Transforming our business foundation for growth. To achieve this long-term vision, we aim to simultaneously supply value for our planet, value for people and society, and value for the market economy, without compromising on any of these values and by enhancing value in each of these areas.

The Sumitomo Forestry Group contributes to the realization of a carbon neutral and nature positive society, by effectively utilizing forest resources, which are renewable natural resources produced from natural capital, and providing "shared benefit" through forest management, manufacturing and distribution of timber and building materials, and wooden construction and renewable energy businesses.

As for the first phase of our long-term vision Mission TREEING 2030, we have announced a three-year Mission TREEING 2030 Phase 1 (2022 -2024) of Medium-Term Management Plan, which provides the groundwork for our future growth and contribution to decarbonization. FY2024 is the final year of the current plan and the time when we will formulate Mission TREEING 2030 Phase 2 (2025-2027), which will start in FY2025. We will identify forms of contribution to the concept of nature positive through the establishment of a circular bioeconomy.

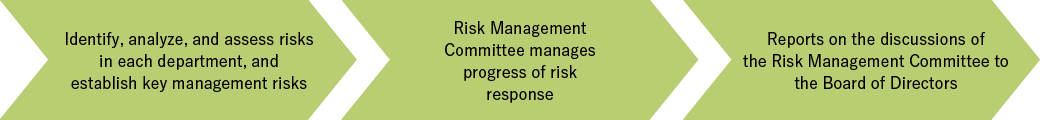

Management of Risks and Impacts

At the Sumitomo Forestry Group, each department decides on specific countermeasures and evaluation indicators for business risks, and reports progress to the Risk Management Committee on a quarterly basis. The Risk Management Committee is chaired by the President as the highest authority on risk management and consists of executive officers and general managers in charge of the Corporate Planning Department, Personnel Department, Legal Department, IT Solutions Department and Sustainability Department, along with divisional managers of each division and the General Manager of the General Administration Department.

In addition, medium- to long-term risks related to ESG issues are discussed extensively covering the entire value chain by the Sustainability Committee, chaired by the President and whose members consist of executive officers, directors and the divisional managers of each division. The committee meets four times a year. The committee will meet regularly six times a year starting in FY2024.

- Click here for related information

Management process of business risks

Process for managing medium- and long-term risks in response to ESG issues

Metrics and Targets

The Sumitomo Forestry Group has established long-term targets related to climate change and is promoting initiatives while incorporating them into its Mid-Term Management Plan Mission TREEING 2030 Phase 1 (2022 - 2024) and annual plans. In 2017, the Group declared its intention to formulate SBTs and formulated new Group-wide greenhouse gases emissions reduction target, which were approved as SBTs in July 2018. In September 2021, we submitted an application to the SBT Initiative secretariat to enhance our Scope 1 and 2 greenhouse gases emissions reduction target for 2030 from the previous 21% to 54.6% reduction, which is in line with a 1.5°C reduction in order to expedite our initiatives. In January 2024, in accordance with latest SBT guidance, we re-established our short-term and long-term reduction targets and newly applied for FLAG (Forest, Land and Agriculture) targets. It is expected to be approved by the end of this fiscal year.

Furthermore, we joined RE100, an international initiative aiming for 100% renewable energy for electricity consumption, in March 2020. We are accelerating our initiatives to cut greenhouse gases emissions toward achieving the goal of using 100% renewable energy for electricity used in the Group's business activities and fuel for power generation in our power generation business by 2040. According to the Mid-Term Sustainability Targets (2022-2024) announced in February 2022, each division will set its own target for the ratio of renewable energy procurement and take necessary budgetary measures, including capital investment, to steadily promote initiatives toward achieving RE100.

We also disclose data corresponding to core global metrics and core sector metrics set forth in the TNFD final recommendations.

- Click here for related information

Responding to TCFD and TNFD

Climate Change Impacts on the Sumitomo Forestry Group (TCFD scenario analysis)

The results of our TCFD scenario analysis* conducted in 2018, 2021, and 2022, respectively, were reported to the Sustainability Committee each time and disclosed in the Sustainability Report. In addition, they will be reflected as numerical targets for each division and headquarters department in the next Mid-Term Management Plan, Mission TREEING 2030 Phase 2 (2025-2027), which will be formulated before the end of FY2024.

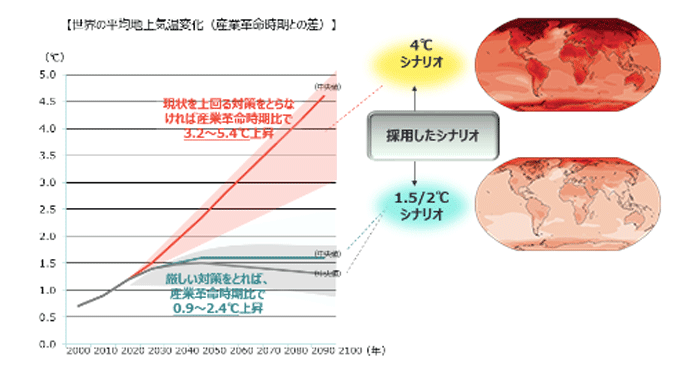

*TCFD scenario analysis: We considered the situation in 2030 using two scenarios: the 4°C scenario, in which no further progress is made in tackling climate change, and the 1.5/2°C scenario, in which progress is made in transitioning the society toward decarbonization.

| Setting scenario | 4°C scenario | 1.5/2°C scenario | |

|---|---|---|---|

| Social image | A scenario where the status quo is maintained, economic development is prioritized, and global temperature rise and its effects continue to worsen | A scenario in which society as a whole takes a major turn toward decarbonization and succeeds in limiting temperature increases | |

| Reference scenario | For transition risks | Stated Policies Scenario (IEA) | Sustainable Development Scenario (IEA) Net Zero Emissions by 2050 (IEA) |

| For physical risks | SSP5-8.5 (IPCC) | SSP1-2.6 (IPCC) SP1-1.9 (IPCC) |

|

| Risks & opportunities | Physical risks and opportunities are likely to become apparent | Transition risks and opportunities are likely to become apparent | |

Source: Compiled from IPCC AR5, AR6, SR1.5, IEA WEO 2020, Net Zero Emission by 2050

Source: Compiled from IPCC SR1.5 and AR6 WG1 SPM

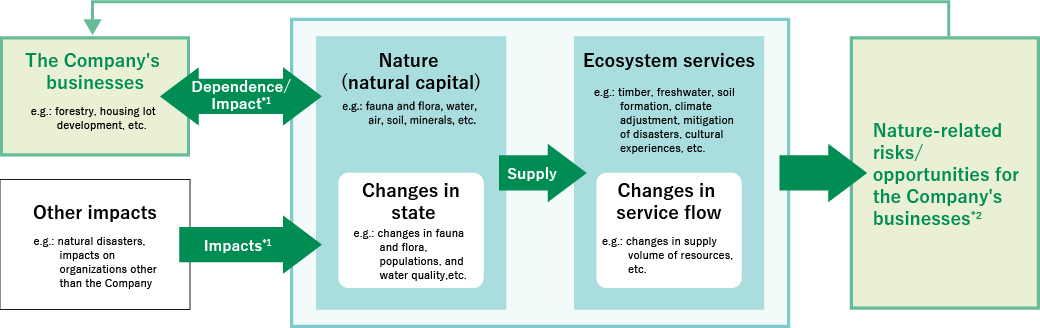

Impacts of nature-related issues on the Sumitomo Forestry Group (TNFD LEAP analysis)

From the end of 2023 to 2024, we organized a working group consisting of members from the headquarters and business divisions to conduct an analysis using the LEAP approach* covering our dependence/impact on nature, risks and opportunities. The findings of this working group were compiled in March 2024. The tools used in each process of the LEAP approach are all recommended by TNFD. The results of this analysis will be reflected in the next Mid-Term Management Plan Mission TREEING 2030 Phase 2 (2025-2027), which will be formulated by each division during FY2024.

*LEAP approach: an integrated approach developed by TNFD to assess nature-related issues such as interfaces with nature and dependencies, impacts, risks, and opportunities in a business. Process consists of locate, evaluate, assess and prepare

Relationship between Sumitomo Forestry's business and nature (examples)

*1Negative impacts: temporary soil degradation due to development

Positive impacts: enhancement of forest ecosystem services through proper management

*2Risks: landslides in planted forest

Opportunities: monetization opportunities for ecosystem services, higher value-added wood products

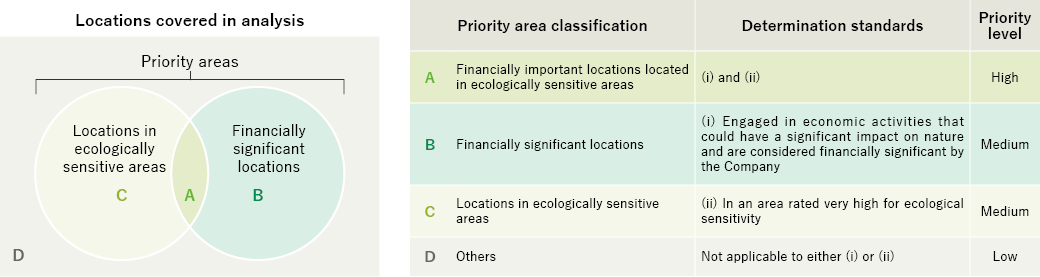

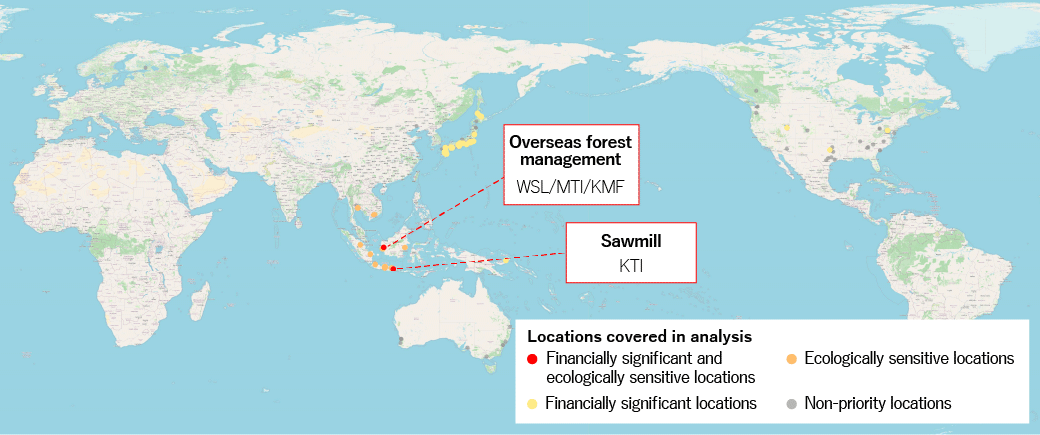

Identification of Priority Sites (Locate)

The “Locate” process involved taking a bird's-eye view of the Sumitomo Forestry Group's supply chain, examining interfaces with nature at each business location, and identifying locations that should be prioritized for response.

First, 148 business locations were selected for evaluation in four businesses that are considered to have particularly large interfaces with nature (timber and building materials, housing, construction and real estate, and natural resources and environment) to ensure that the number of locations was not biased toward any particular business from direct operations and locations upstream and downstream in the supply chain of each business.

| Business segment | Business | Upstream | Direct operations | Downstream | |||

|---|---|---|---|---|---|---|---|

| Scope and data source | Number of business sites subject to analysis | Scope and data source | Number of business sites subject to analysis | Scope and data source | Number of business sites subject to analysis | ||

| Timber and Building Materials Business |

Manufacturing | Supplier list | 4 | Company’s own manufacturing plants | 12 | Buyers: not subject to analysis because, like the Housing Business, a majority consists of other companies | ‒ |

| Distribution | Supplier list | 4 | Not subject to analysis | ‒ | Buyers: not subject to analysis | ‒ | |

| Housing Business | Custom-built detached houses and subdivisions | Supplier list | 4 | Subdivision housing areas where we have large blocks | 8 | Use: Not subject to analysis

Waste: Landfills where we dispose of large amounts of waste |

10 |

| Renovation | Same as custom-built detached houses and subdivisions | ‒ | Business sites with orders of 100 million yen or more | 5 | Use: Not subject to analysis

Waste: Same as custom-built detached houses and subdivisions |

‒ | |

| Greening | Supplier list for materials | 8 | Green spaces with large areas of environmental greening | 20 | Use: Not subject to analysis

Waste: Same as custom-built detached houses and subdivisions |

‒ | |

| Global Construction and Real Estate Business | Custom-built detached houses and subdivisions | Supplier list for construction materials | 6 | Custom-built detached houses and subdivision areas in the United States (16 states) and Australia (5 states) | 29 | Use: Not subject to analysis

Waste: Final disposal outside of scope |

‒ |

| FITP | Supplier list | 2 | Panels plant | 5 | Use: Same as custom-built detached houses and subdivisions | ‒ | |

| Real estate development | Supplier list for construction materials | 1 | Development business in Indonesia and Thailand | 2 | Use: Not subject to analysis

Waste: Final disposal outside of scope |

‒ | |

| Environment and Resources Business | Company-owned forests | Uses supplier list for the timber building materials business | ‒ | Company-owned forests in Japan (Hyuga, Mombetsu, Niihama) | 14 | Use: Not subject to analysis because sales are to the Company’s own timber building materials business | ‒ |

| Overseas forest management | ‒ | Overseas forest management (New Zealand, Papua New Guinea, and Indonesia) | 5 | Use: Main buyers | 2 | ||

| Biomass Power Generation | ‒ | Biomass Power Generation Plant | 6 | Waste: Main business partners | 1 | ||

| Total 29 | Total 106 | Total 13 | |||||

Next, the location information of the locations was overlaid and evaluated using geographic information systems (GIS) and other tools, and ecosystem information using nature-related risk analysis tools such as ENCORE*1. As a result, of the 148 locations listed above, we narrowed down the list to those that are financially significant or located in ecologically sensitive areas.

For financially significant locations (B in the “Classification of Priority Areas” figure), selection was based on actual conditions, with the basic criterion that one or more of the rating items in ENCORE must be very high, and that the ratio of sales or transaction value to each business must be 10% or more, and that in the event of an emergency it is considered difficult to replace the location within one year.

For locations located in ecologically sensitive areas (C in the figure “Classification of Priority Areas”), the sensitivity of the ecosystem in which each location is located was assessed using ENCORE and IBAT*2 , etc. to evaluate five requirements ([1] significance of biodiversity, [2] high integrity of the ecosystem, [3] rapid decline in ecosystem integrity, [4] significance of providing ecosystem services and [5] physical water risk) on a five-point scale [1-5]). Locations with an average score of 4 or higher for the five requirements were selected.

*1ENCORE: Exploring Natural Capital Opportunities, Risks and Exposure. A nature-related risk analysis tool developed by the Natural Capital Finance Alliance, an international financial industry organization for the natural capital sector, and others.

*2IBAT: Integrated Biodiversity Assessment Tool. Integrated Biodiversity Assessment Tool developed by the World Conservation Monitoring Centre of the United Nations Environment Programme and others to integrate biodiversity information globally.

Classification of Priority Areas

As a result, we identified 37 “priority locations” that need to be addressed with priority. In addition, two priority locations considered financially significant and located in ecologically sensitive areas (A in the figure “Classification of Priority Areas”) were identified in overseas forest management PT. Wana Subur Lestari (WSL), PT, Mayangkara Tanaman Industri (MTI), PT. Kubu Mulia Forestri (KMF) of Indonesia and manufacturing plant Kutai Timber Indonesia (KTI) were identified.

Scores for identified priority locations and the sensitivity of the ecosystem in which each is located

| Importance of biodiversity | Ecosystem integrity (high integrity) | Ecosystem integrity (rapid decline) | Importance of providing ecosystem services | Physical water risks | Total assessment | |

|---|---|---|---|---|---|---|

| WSL/MTI/KMF | 4 | 5 | 5 | 3 | 5 | 4.4 |

| KTI | 4 | 3 | 5 | 3 | 5 | 4.0 |

Analysis tools used as an assessment criterion for ecologically sensitive areas

| Requirements for ecologically sensitive areas | Overview | Tools used in the assessment*1 | |

|---|---|---|---|

| (1) Biodiversity Importance | Areas of biodiversity importance (protected areas, areas of scientific importance, areas with endangered species, etc.) |

World Database on Protected Area (WDPA): Comprehensive database of protected areas and other protected areas on land and in the ocean around the world Key Biodiversity Area (KBA): Areas scientifically recognized as having biodiversity importance IUCN Red List of Threatened Species:A list of endangered species from around the world |

|

| Ecosystem Integrity | (2) High Integrity*2 | Areas of high ecosystem integrity (the degree to which ecosystem composition, structure, and function are within natural variability) |

Biodiversity Intactness Index: an index of ecological integrity from 0 to 1 for sites around the world IUCN Red List of Ecosystem database: a geographic compilation of trends in ecosystem collapse risk by integrating data on ecosystem area and ecosystem integrity |

| (3) Rapid Decline*2 | Areas where rapid loss of ecosystem integrity is reducing the resilience of ecosystem service provision | Biodiversity Intactness Index: an index of ecosystem integrity that uses changes in ecosystem integrity to assess changes over time by country (see above for indicators) | |

| (4) Ecosystem Service Delivery Importance*2 | Areas where ecosystem service provision is important, including indigenous communities and local communities |

ENCORE: a map showing hotspots of natural capital decline and depletion by location that are important for the provision of ecosystem services LANDMARK: a platform for information on land ownership by indigenous peoples and local residents at various locations around the world. |

|

| (5) Water Physical Risk | Areas of high physical water risk, including water use restrictions, flooding, and poor water quality | Aqueduct: a comprehensive water risk score calculated by combining 13 water risk indicators, including water quantity, water quality, and reputational risk at each business site | |

*1Comprehensive assessment criteria were extracted from the tools described in the TNFD LEAP Guidance based on the availability of data, natural capital to be evaluated, and other factors.

*2For (2) high integrity and (4) significance of providing ecosystem services, a 50 km buffer was established around the location to determine overlap with the data set for assessment. Regarding (3) rapid decline, the year 2000, when our overseas forest management and administration were in full operation, was used as the base year, and the year 2023 was used as the comparison year.

*The table above was compiled based on Guidance on the identification and assessment of nature-related issues: The LEAP approach v1.0.

*Company-owned forests covering large areas were analyzed by establishing centroids and 30-50 km buffers for each geographic mass, with individual centroids for enclaves not included in the buffers, and integrating the results in favor of higher-risk results.

Diagnosing Priority Locations (Evaluate)

The Evaluate process assessed the dependence and impact of the Group's operations on nature at 37 priority locations. Based on ENCORE results from the Locate process and regional characteristics from analytical tools such as Aqueduct and IBAT, we qualitatively assessed the dependence and impact of each priority location. Impacts were evaluated both positively and negatively, including the analytical tools as well as the company's own knowledge through its business. The results of the Evaluate process are shown below.

| Business segment | Dependence | Positive impacts | Negative impacts |

|---|---|---|---|

| Timber and Building Materials Business |

Timber supply service driven by forest ecosystems Soil maintenance and flood prevention services |

(Not applicable because it mainly engages in production activities) |

Alteration of surrounding forests and soil degradation due to procurement of logs Water pollution to surrounding water bodies due to wastewater from manufacturing plants |

| Housing Business, Global Construction and Real Estate Business | Soil maintenance and landslide prevention services | Maintain and improve ecosystem services (rainwater recharge, water purification, habitat provision) by enhancing natural symbiotic functions (greening, water retention/permeable pavement, biodiversity initiatives, etc.) within housing and construction sites | Waste discharge, water use, and invasion of non-native species associated with subdivision development |

| Environment and Resources Business |

Surface water and soil provision service driven by forest ecosystems Raw material supply service for power generation fuel (wood, PKS*, coal) Surface water supply service for steam turbine-based power generation |

Maintain and improve ecosystem services (carbon storage, water cycle, disaster prevention, habitat provision) through sustainable forest and peatland management Supporting the demand for wood resources through the use of wood chips in power generation projects promotes sustainable forest management in the region |

Impacts on livelihoods of forest-dependent communities Habitat fragmentation for plants and animals due to tree cutting Waste emissions and water and air pollution resulting from power generation facilities |

*PKS: Palm Kernel Shell.

Comment from an expert

The Sumitomo Forestry Group reported to and obtained advice from external stakeholder experts on the process of narrowing the Locate and Evaluate processes of the TNFD LEAP approach conducted from December 2023 to February 2024.

■Mutai Hashimoto, Lead, Sustainable Finance, WWF Japan

For many years, Sumitomo Forestry has implemented a procurement policy aimed at avoiding negative impacts on nature in wood procurement, and its disclosures are in line with SBT for Nature's recommended framework for actions to achieve nature positivity (AR3T). Although many of the nature-related opportunities listed have a clear business connection at this point in time, it is expected that the restoration of nature itself will be extracted as a nature-positive opportunity more broadly, and that these opportunities will be linked to business opportunities in the future.

■Makino Yamanoshita, Joint Programme Director, Biodiversity & Forests, Institute for Global Environmental Strategies

While it is academically recognized that climate change measures and the conservation of biodiversity and ecosystem services are interdependent, I found it very interesting that Sumitomo Forestry's efforts to find common analytical results in the analytical process from the business perspective corresponding to the TCFD and TNFD, and to report these results in an integrated manner. As the Company moves ahead with further analysis, there may be a need to consider tradeoffs in addition to synergies. Furthermore, I believe that true nature positive can be achieved by utilizing nature-related information and on-the-ground experience accumulated by Sumitomo Forestry in its overseas forest management operations and other activities at project sites, which are not represented in the database and other information presented by the TNFD, in future TNFD LEAP analyses and by implementing countermeasures.

Main Risks and Opportunities Identified (Assess)

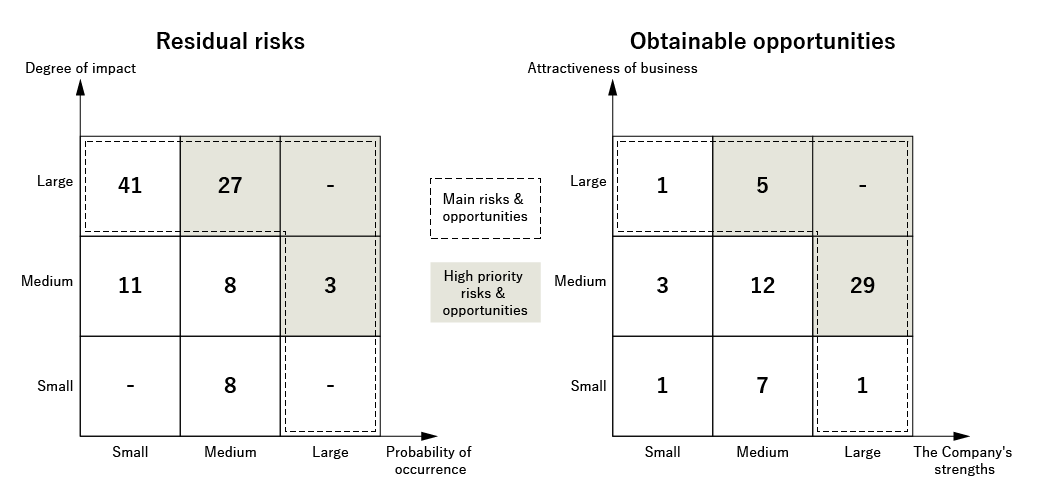

The Assess process identified business risks and opportunities arising from the dependence and impacts on nature determined in the Evaluate process, each of which was qualitatively assessed, with the main ones identified. First, we conducted a risk/opportunity analysis for 25 locations, which were selected evenly from priority locations to avoid bias toward specific businesses. Based on what had already been addressed, a qualitative assessment was made of the remaining risks and the priority of obtainable opportunities.

The residual risks were qualitatively prioritized based on the criteria of “degree of impact” for financial impact on the business and “probability of occurrence” for past cases and existing initiatives. For obtainable opportunities, we qualitatively prioritized them based on the criteria of “business attractiveness” in terms of the amount of increase in market size* by 2030, and “our strength” in terms of our advantage in capturing such opportunities.

| Size of impact | Probability of occurrence | ||

|---|---|---|---|

| Definition | Financial impacts in business (sales of business sites and replaceability) |

Presence of examples of similar incidents occurring in the past and existing initiatives | |

| Standard | Large | Impacts amounting to 10% or more of the division’s sales | No existing initiatives implemented in the past |

| Medium | Less than 10%, but difficult to replace within a year/ More than 10% but can be replaced within a year |

Occurred in the past but there are existing initiatives in place/ Has not occurred in the past and there are no existing initiatives |

|

| Small | Can be replaced within a year | Has not occurred in the past and there are existing initiatives | |

| Attractiveness of business | The Company’s strengths | ||

|---|---|---|---|

| Definition | Amount of increase* in market value by 2030 | The Company’s competitiveness in acquiring opportunities | |

| Standard | Large | 30 trillion yen or higher | Has relevant resources and existing initiatives |

| Medium | 5 to 30 trillion yen | Has relevant resources but no existing initiatives/ Does not have relevant resources but has existing initiatives |

|

| Small | Up to 5 trillion yen | ||

*Estimated based on Identifying Biodiversity Threats and Seizing Business Opportunities published by AlphaBeta in July 2020 and New Nature Economy Report II: The Future of Nature and Business published by the World Economic Forum in July 2020.

The main opportunities and risks identified in the TCFD scenario analysis conducted over the last year and the main opportunities and risks identified in this TNFD LEAP analysis are as follows.

Forests and trees, the core of Sumitomo Forestry Group's business, absorb and fix atmospheric carbon as they grow, while at the same time nurturing biodiversity and providing ecosystem services. These characteristics led to common or similar results for several items in the TCFD scenario analysis and TNFD LEAP analysis, suggesting that in the Sumitomo Forestry Group's business, efforts toward decarbonization are also expanding nature-related business opportunities.

| Division*1 | Business | Transition Risks | Physical Risks | Opportunities | |

|---|---|---|---|---|---|

| Timber and Building Materials Business | Distribution and manufacturing of timber and building materials | C |

Cost increase due to introduction of carbon tax and stricter environmental regulations Increased wood procurement costs due to higher reforestation costs |

Decrease in value of wood and sales due to growing preference for more robust buildings as a result of more severe disasters |

Increase in demand for renovation to environmentally conscious housing due to stricter environmental regulations, and increase in sales of timber and building materials Increase in sales due to development of processing technology for materials for environmentally conscious housing and medium- to large-scale buildings |

| C ・ N |

Costs increase due to compliance with stricter laws and regulations related to illegal and unsustainable forest harvesting Costs increase due to higher wood procurement prices in response to increased demand for wood products to promote decarbonization, etc. |

Sales decrease and restoration costs increase due to severe flood damage from heavy rain and other factors or due to shutdown of operations Sales decrease and restoration costs increase due to suspension of operations following landslide in planted forests near plants Procurement costs increase due to reduced wood supply resulting from disasters and ecological degradation at procurement sites |

Sales increase owing to biorefinery technology and new product development Sales increase due to development of new products for the mass timber market Sales increase due to development of new products that contribute to the circular economy in the construction market |

||

| N |

Costs increase to comply with stricter soil and water pollution laws and regulations Sales decrease due to friction with local communities and NGOs caused by the construction of forest roads in areas that affect the surrounding ecosystem Increased costs of dealing with litigation and complying with stricter laws and regulations due to the impact of waste, water use, soil contamination, and land alteration on protected areas, etc. |

Sales decrease due to less water available in the surrounding area as a result of reduced water availability Sales decrease due to shutdowns caused by fire, land subsidence, tsunami, and landslides in the event of an earthquake Sales decrease due to shutdown of operations caused by fire and volcanic ash during a volcanic eruption |

Procurement costs decrease due to conversion from natural wood to wood from planted forests Reduction of water procurement costs through further water conservation in manufacturing processes and reduced and more efficient water use Costs decrease by maintaining stable raw material procurement in conjunction with resident-involved timber production (social forestry) |

||

| Housing Business | Custom-built houses, subdivision houses, greening (in Japan) |

C |

In the short term, technological development costs and construction costs for LCCM housing* and medium- to large-scale buildings will increase The value of wood will decline relatively over the long term due to the advancement of decarbonization technologies for steel, concrete, and other building materials, and sales of wooden buildings will decline |

Decrease in sales of timber and building materials due to growing preference for more robust buildings as a result of more severe disasters |

Increasing demand and sales of LCCM (Life-Cycle Carbon Minus) homes in response to growing decarbonization orientation Sales increase of environmentally conscious multi-family housing due to customer preferences, policy changes, etc. |

| C ・ N |

― |

Sales decrease due to construction delays caused by increased disaster risk Increased costs of premium payments to insurance companies due to increased disaster risk |

Sales increase due to sales at premium prices in conjunction by enhancing natural symbiotic functions (greening, water retention/permeable pavement, biodiversity initiatives, etc.) within housing and construction sites | ||

| N | Costs increase due to compliance with stricter laws and regulations associated with adverse impacts on surrounding communities and ecosystems due to waste, water use, and soil contamination | ― |

Reduced industrial waste disposal costs by curbing waste generation and promoting the conversion of waste into valuable resources Costs (e.g., greenkeeping) decrease through green space management with reduced ecological impact (e.g., reduced use of pesticides and fertilizers, less intense pruning, etc.) Sales increase owing to the increased trust of client companies and the realization of long-term contracts as a result of an increase in the number of users from the development of the environmental education business, as well as the identification and protection of rare and native plant species in parks in the designated management operations |

||

| Global Construction and Real Estate Business | Detached houses business (overseas), building materials manufacturing (United States), real estate development (Japan and overseas) | C |

Cost increase due to introduction of carbon tax and stricter environmental regulations Brand value loss due to delay in complying with environmental regulations, stock price slump, and sales decline |

Increased material procurement costs due to construction damage, extended construction time, and supply chain disruptions caused by severe disasters Intensifying competition to secure development sites due to a shift in demand to areas with less risk of disasters |

Increasing demand for environmentally conscious housing in response to the growing trend toward decarbonization among customers Expansion of the market for medium- to large-scale wooden constructions in response to ESG demand from investors and financial institutions |

| C ・ N |

Costs increase due to higher wood procurement prices in response to increased demand for wood products to promote decarbonization, etc. | Increased costs of insurance premium payments for properties under construction due to increased risk of natural disasters | Sales increase owing to the acquisition of new customers who value the natural environment following enhanced natural symbiotic functions (greening, water retention/permeable pavement, biodiversity initiatives, etc.) within housing and construction sites | ||

| N |

Increased pollution control costs due to delay in introduction of technologies to reduce environmental impact Costs increase due to delays in introducing technologies to reduce the impact on ecosystems (e.g., noise and vibration control, dust control, planting with native species, etc.) |

― |

Costs decrease through promotion of efficient construction methods (panelization and trussing) during construction Sales increase from the development of new products reusing waste materials Sales increase owing to improved reputation among customers as a result of procurement of certified wood, use of recycled wood, and certification of plants |

||

| Environment and Resources Business | Forest management, seedling production, and biomass power generation | C |

Decrease in wood production due to stricter forest protection policies Increased cost of installing energy-efficient heavy equipment due to the introduction of carbon taxes and stricter environmental regulations |

Increased forest road networks damage and road repair costs due to changes in precipitation and weather patterns Increased forest fires due to higher average temperatures, increased wood procurement and reforestation costs |

Increased demand for logs and wood due to customers' preference for decarbonization Increased demand for renewable energy due to strengthened decarbonization policies, and increased sales of biomass-derived energy business |

| C ・ N |

Costs increase due to compliance with stricter laws and regulations following the introduction of policies to promote certification of woody biomass feedstock and PKS Costs increase due to higher fuel costs resulting from increased demand and tougher competition for woody biomass feedstock and PKS Costs increase due to further changes in forest management practices to meet the growing demand for sustainable timber Costs increase due to delays in the introduction of efficient and advanced forestry technology |

Sales decrease due to shutdown of operations caused by forest fires or landslides | Sales increase from the generation of carbon credits in connection with the promotion of forest and peatland management and forest fund operations | ||

| N |

Sales decrease due to unplanned shutdowns following criticism from local communities and NGOs for timber production that violates the rights of indigenous and local people Sales decrease and costs increase as a result of delays in introduction of woody biomass fuels with less impact on ecosystems |

― |

Sales increase owing to sales of forest management technologies such as remote sensing, drone surveys, satellite applications, etc. Sales increase through payment program development (PES) from companies and local governments that benefit from the forest's public benefits (groundwater recharge, habitat provision, landslide prevention, etc.) Sales increase through the provision of industrial tourism and eco-tourism products (e.g., sales of products utilizing traditional knowledge and culture) Reduced industrial waste disposal costs by promoting the conversion of incineration ash into valuable resources Sales increase by promoting the credit market through participation in rulemaking for biodiversity credits |

||

| Lifestyle Services Business | Nursing home operations and insurance business, etc. | C | Decrease in sales of gasoline card business due to shift from gasoline to electric vehicles |

Increase in costs for renovation of owned facilities and BCP response due to the severity of disasters Decrease in customers using owned facilities due to rising temperatures and increased costs for safety considerations |

Increase in insurance subscribers, shorter policy periods, more frequent renewals, and sales due to more severe disasters Increase in the number of Sumirin Denki subscribers due to customers' preference for renewable energy Customer acquisition by responding to customers' desire for decarbonization and for safety and security in the face of increasingly severe natural disasters |

(C): Items identified only through TCFD scenario analysis

(C/N): Items identified from both TCFD scenario analysis and TNFD and LEAP analysis

(N): Items identified only through TNFD and LEAP analysis

*1The Lifestyle Services Business underwent TCFD scenario analysis only.

*2LCCM housing: houses that reduce CO2 emissions during construction, occupancy, and demolition, and also generate renewable energy using solar power generation, etc., to achieve negative CO2 emissions over their entire life cycle.

Financial significance analysis (TCFD scenario analysis and TNFD LEAP analysis)

In terms of the TCFD scenario analysis, among the risks and opportunities identified through the business-by-business analysis, some are affecting more than one business, and the business and items experiencing particularly large financial impacts are presented below. The increasing operating costs associated with the introduction of the carbon tax, environmental regulations, and the intensification of weather-related disasters will affect Timber and Building Materials Business and all divisions, while the growing preferences of customers for decarbonization will present opportunities for Environment and Resources Business and all divisions.

| Factors | Factors of Particular Impact* | Related Business | ||

|---|---|---|---|---|

| Transition Risks | Policies and Regulations | Introduction of Carbon Pricing | [Risks]

Increase in business costs due to the introduction of carbon tax imposition and emission trading system (Timber and Building Materials, Environment and Resources) |

Timber and Building Materials, Housing, Global Construction and Real Estate, Environment and Resources, Lifestyle Services |

| Forest conservation policies | [Risks]

Increase in wood procurement costs due to payment of logging tax, logging fees, etc. (Timber and Building Materials, Environment and Resources) Increase in domestic wood costs due to the shift of reforestation costs as a result of mandatory reforestation, etc. (Timber and Building Materials) |

Timber and Building Materials, Environment and Resources | ||

| Introduction of environmental regulations | [Risks]

Governments implement regulations on the use of used vehicles, which will increase the cost of introducing heavy equipment and trucks (Environment and Resources) [Opportunities]

Increase in sales due to increased demand for environmental certifications/low-carbon housing in response to stricter regulations on buildings (Global) |

Timber and Building Materials, Housing, Global Construction and Real Estate, Environment and Resources, Lifestyle Services | ||

| Market | Shift in customer orientation toward decarbonized products | [Opportunities]

Increase in sales due to increased demand/use of domestic wood by utilizing wood industrial complex and laminated engineered wood plants (Timber and Building Materials) Increase in sales due to higher unit prices for logs and wood, associated with increased demand for renewable raw materials and products (Environment and Resources) |

Timber and Building Materials, Housing, Global Construction and Real Estate, Environment and Resources, Lifestyle Services | |

| Increased cost of raw materials | [Risks]

Increase in raw material costs due to higher energy costs (Timber and Building Materials) |

Timber and Building Materials, Housing, Global Construction and Real Estate | ||

| Technology | Advances in next-generation technologies | [Risks]

Decrease in sales due to lower demand for wood as a result of progress in research and development of decarbonization of steel materials and concrete, which are competitors of wood (Timber and Building Materials) |

Timber and Building Materials, Housing, Global Construction and Real Estate, Environment and Resources | |

| Physical Risks | Acute | Intensifying weather disasters | [Risks]

Decrease in sales due to increased demand for robust buildings using building materials other than wood and decreased disruption for wooden buildings (Housing) Cost increase due to higher purchase prices caused by supply chain damage (Global) |

Timber and Building Materials, Housing, Global Construction and Real Estate, Environment and Resources, Lifestyle Services |

*The amount of impact is 10% or more of each division's ordinary income.

In the TNFD LEAP approach, there were 71 remaining significant risks and 36 potential opportunities identified from the qualitative assessment results, of which 30 risks were rated as high priority in terms of “degree of impact” and “probability of occurrence” based on the following qualitative assessment criteria, and 34 opportunities were rated as high priority in terms of “business attractiveness” and “strengths of the company.”

We also attempted to quantify the financial impacts of eight of the above risks and 11 of the opportunities listed in the table below. This includes those that cannot be quantified at this time and those for which quantification has not yet been completed.

Among the remaining risks, for example, in the Timber and Building Materials Business, under the scenario of manufacturing sites shutting down due to increased risk of inland flooding caused by climate change, the financial impact of “reduced sales and increased recovery costs due to the shutdown of four direct operation sites” was indicated as significant.

Among the obtainable opportunities, for example, in the same Timber and Building Materials Business, under a scenario where the promotion of wood use is promoted as a policy around the world as a means to achieve carbon neutrality and nature positive, the financial impact of “increased sales from new product development related to the mass timber market, such as CLT” was significant.

Regarding scenarios, we utilize some of the scenario analysis for physical risks from TCFD that has been already conducted, and we plan to conduct a full-scale scenario analysis for TNFD in the future.

| Item (risks) | Items for which attempts were made to quantify the financial impacts | Business | Size of impact | Probability of occurrence | |||

|---|---|---|---|---|---|---|---|

| Transition Risks | Policies | Change in raw material procurement | Procurement costs for PKS increase due to compliance with stricter laws and regulations following the introduction of policies to promote certification | Short to medium term | Environment and Resources (biomass power generation) | ||

| Legal responsibilities | Introduction of environmental regulations | Costs increase due to compliance with stricter laws and regulations in response to the use of timber related to illegal and unsustainable forest harvesting | Short term | Timber and Building Materials (manufacturing and distribution) | |||

| Market | Change in raw material procurement | Costs increase due to higher fuel costs resulting from increased demand and tougher competition for woody biomass feedstock and PKS | Short to medium term | Environment and Resources (biomass power generation) | |||

| Physical Risks | Acute | Occurrence of disasters | Sales decrease and restoration costs increase due to shutdown of operations caused by severe and more frequent flood damage from heavy rain and other factors | Short to long term | Timber and Building Materials (manufacturing) | Large | Medium |

| Sales decrease and restoration costs increase due to suspension of operations following landslide in planted forests near plants | Long term | Timber and Building Materials (manufacturing) | |||||

| Chronic | Occurrence of disasters | Increased costs of insurance premium payments for properties under construction due to increased risk of natural disasters | Short to medium term | Housing (custom-built detached houses), Global Construction and Real Estate (detached and subdivision houses) | |||

| Sales decrease due to construction delays caused by vulnerable construction infrastructure and increased risk of natural disasters resulting from land modification in the surrounding areas | Long term | Global Construction and Real Estate (detached and subdivision houses and real estate development) | |||||

| Change in raw material procurement | Procurement costs increase due to reduced wood supply resulting from disasters and ecological degradation at procurement sites | Long term | Timber and Building Materials (manufacturing) | ||||

| Item (opportunities) | Items for which attempts were made to quantify the financial impacts | Business | Attractiveness of business | The Company’s strengths | |||

|---|---|---|---|---|---|---|---|

| Business performance | Market | Expansion of consulting market | Sales increase owing to sales of natural symbiosis site consulting in Japan | Short to medium term | Environment and Resources (company-owned forests in Japan) | Medium | Large |

| Expansion of credit market | Sales increase by promoting the credit market through participation in rulemaking for biodiversity credits | Medium to long term | Environment and Resources (company-owned forests in Japan and overseas forest management) | ||||

| Change in wood product market | Sales increase owing to new product development such as biorefinery, CLT or reuse of waste materials, etc. | Medium to long term | Timber and Building Materials (manufacturing) | ||||

| Products and services | Change in wood product market | Sales increase owing to sales of forest management technologies such as remote sensing, drone surveys, satellite applications, etc. | Short to medium term | Environment and Resources (company-owned forests in Japan and overseas forest management) | |||

| Spread of NbS | Sales increase from the provision of industrial tourism and eco tourism products | Medium to long term | Environment and Resources (company-owned forests in Japan) | Large | Medium | ||

| Sales increase through payment program development (PES) from companies and local governments that benefit from the forest's public benefits | Short to long term | Environment and Resources (company-owned forests in Japan and overseas forest management) | |||||

| Resource efficiency | Shift to efficient use of resources | Reduction of water procurement costs through further water conservation in manufacturing processes and reduced and more efficient water use | Medium to long term | Timber and Building Materials (manufacturing) | Medium | Large | |

| Costs decrease due to conversion from natural wood to wood from planted forests | Medium to long term | Timber and Building Materials (manufacturing) | |||||

| Costs decrease through promotion of efficient construction methods (panelization and trussing) during construction | Medium to long term | Global Construction and Real Estate (real estate development) | |||||

| Reduced industrial waste disposal costs by promoting the conversion of incineration ash into valuable resources | Short term | Environment and Resources (biomass power generation) | |||||

| Reputation | Spread of green infrastructure | Sales increase owing to the acquisition of new customers who value the natural environment following enhanced natural symbiotic functions (greening, water retention/permeable pavement, biodiversity initiatives, etc.) within housing and construction sites | Medium to long term | Global Construction and Real Estate (detached and subdivision houses and real estate development) and Housing (custom-built detached houses) | |||

*All risks and opportunities at direct operation locations are quantified and shaded.

*Short-term: from the present to 2024 (Mission Treeing 2030 Phase 1), medium-term: from 2025 to 2030 (Mission Treeing 2030 Phase 2 and beyond), and long-term: from 2031 to 2050.

Sumitomo Forestry's Countermeasures (Prepare)

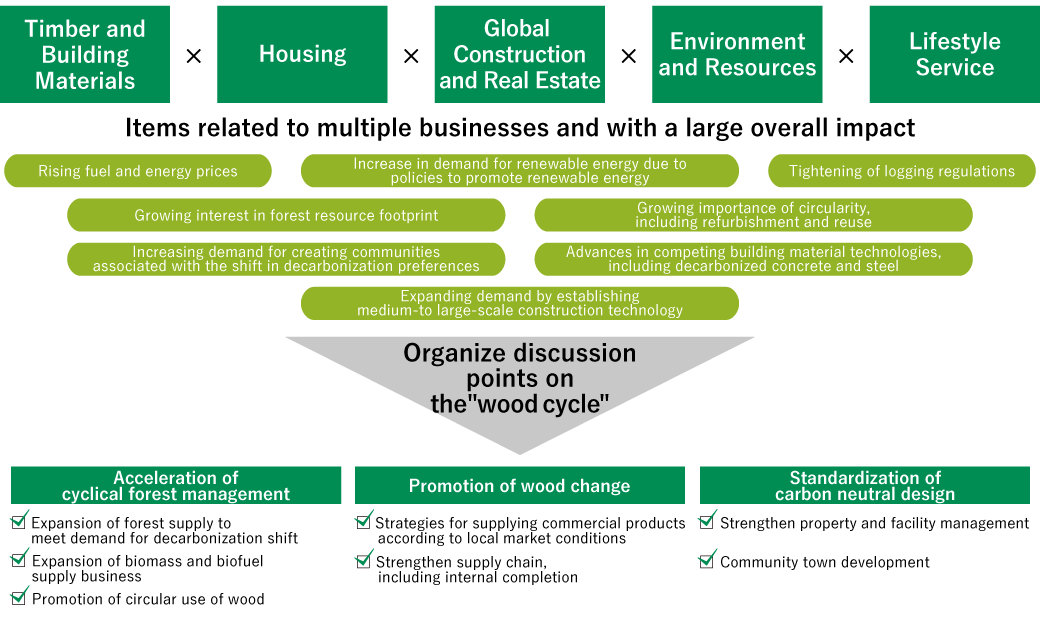

In the TCFD scenario analysis conducted for all divisions from the end of 2022 to 2023, among the risks and opportunities identified in the business-by-business analysis, we identified items that affect multiple businesses. Of these, we identified particularly important items as cross-organizational issues, for which all divisions jointly discussed countermeasures.

Relationship Between Cross-organizational Issues/Countermeasures in TCFD Scenario Analysis and the Wood Cycle

Proposed countermeasures identified through joint discussions with all divisions

| Items corresponding “wood cycle” | Cross-organizatioal issues | Countermeasures | |

|---|---|---|---|

| Energy | Forest | Expansion of forest supply to meet demand for decarbonization shift |

Development of tree species and forests in response to the decarbonization shift, such as fuel wood and high-strength wood Development of supply and demand for local production for local consumption (secure and consolidate mountain owners) |

| Wood | Expansion of biomass and biofuel supply business | Expand applications for wood chips and pellets that can be disposed of or used for biorefinery/SAF fuel by utilizing abundant forest resources and wood technology (considering development of wood-based SAF and challenging a demonstration plant) | |

| Materials | Wood | Strategies for supplying commercial products according to local market conditions | In order to standardize decarbonized design for medium- to large-scale buildings, on the basis of implementation and participation in planning activities, define the strategies of each region, select/cultivate company-owned forests, and develop commercial materials |

| Wood and Construction | Promotion of circular use of wood | New product design from the perspective of improving the scope and possibility of wood reuse at the time of demolition while lengthening the wood life cycle, and expanding the scope of reuse of demolition materials outside of the Kawasaki Chip Plant (biomass) | |

| Construction | Construction | Strengthen property and facility management | Expanding the stock-type business as building management to reduce GHG emissions after construction, from the viewpoint of building contracting |

| Construction | Community townhouse development | Appeal from the perspective of environmental friendliness, in addition to the competitiveness of wood | |

| Overall | Forest, Wood and Construction | Strengthen supply chain, including internal completion |

Upstream: the allocation of company-owned forests to be determined in consideration of the position of the forestry fund in the resource strategy, as well as supply chain efficiency Midstream: study and design the location and routing of production and distribution sites in accordance with upstream and downstream supply chain requirements Downstream: establish supply chain requirements by type of new construction, renovation/remodeling, etc., of houses, and coordinate with other departments |

The TNFD LEAP analysis utilizes some of the scenario analysis for physical risks from TCFD that has already been conducted. In anticipation of promoting nature-positive businesses in the next Mid-Term Management Plan Mission TREEING 2030 Phase 2 (2025-2027), we plan to conduct a full-scale scenario analysis of TNFD in the future.

Key measures to address identified priority risks and opportunities include the following.

| Risks & opportunities | Proposed measures | ||

|---|---|---|---|

| Timber and Building Materials Business (Manufacturing) | Risks | Sales decrease and restoration costs increase due to shutdown of operations at SRP, ASTI, RPI, and VECO, four sites at high risk of internal flooding as a result of severe flooding from heavy rains, etc. |

Consider flood risk when selecting sites for operations and enhance disaster prevention measures Establish a business continuity plan (BCP) in the event of a major disaster and establish a rapid recovery system |

| Global Construction and Real Estate Business (FITP) | Opportunities | Sales increase and costs decrease owing to development of new products that reuse waste materials and development of technologies for more efficient use of resources, etc. | Promote the development of products that make effective use of resources in cooperation with the recycling industry to differentiate products in the market |

| Environment and Resources Business (Company-owned forests in Japan, and overseas forest management) | Opportunities | Sales increase owing to sales of smart forest technologies such as remote sensing, drone surveys, satellite applications, etc. |

Develop a service package that supports accurate understanding of forest health and resource quantity by utilizing the latest remote sensing, drone survey, and satellite technologies, and propose to improve the efficiency and accuracy of forest management Deploy marketing activities for service packages targeting local governments and companies with large company-owned forests |

| Environment and Resources Business (Biomass Power Generation) | Risks | Costs increase due to higher fuel costs at Mombetsu Biomass Electric Power Plant and Hachinohe Biomass Electric Power Plant, following increased demand and intensified competition for unused wood chips and imported PKS |

Diversify raw material procurement by developing alternative fuels and new sources of supply Utilize long-term and forward contracts to manage the risk of fuel cost volatility |

- Home

- Sustainability Report

- Environment

- Responding to TCFD and TNFD