- Home

- Sustainability

- Environment

- Disclosures Based on the Four Pillars of TCFD and TNFD

Disclosures Based on the Four Pillars of TCFD and TNFD

Our Approach to Climate Change and Nature-Related Issues

The Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) states unequivocally that human activity is warming the air, seas and land, causing extreme weather and increases the frequency of occurrence, and that greenhouse gases emissions are strongly related to changes in ice sheets and sea levels. In addition, according to the report Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, published by the World Economic Forum in January 2020, more than half of the world's GDP, or 44 trillion US dollars, is nature itself or the services it provides, and loss of nature has a particularly large impact on the agriculture, forestry, fisheries, and construction industries. The international community has proposed the concept of "Nature Positive," which calls for halting the loss of nature or reversing it by 2030, compared to 2020, and fully restoring it by 2050.

Against this backdrop, society's expectations for the role of forests in absorbing CO2 and fixing carbon and providing ecosystem services, timber and wood products supplied from sustainable forests, carbon fixation and reduction of greenhouse gas emissions through wooden buildings, and the use of unused forest resources as biomass fuel are increasing.

In February 2022, we announced "Mission TREEING 2030," our long-term vision that incorporates our business concept behind the Sumitomo Forestry Group's ideal vision for 2030, which is also the target year of the SDGs. "Mission TREEING 2030" sets out the following four strategies as our business policy: 1. Maximizing the value of forests and the wood to create decarbonization and create a circular bioeconomy; 2. Advancing globalization; 3. Striving for transformation and the creation of new value; and 4. Transforming our business foundation for growth. To achieve this long-term vision, we aim to simultaneously supply value for our planet, value for people and society, and value for the market economy, without compromising on any of these values and by enhancing value in each of these areas.

The Sumitomo Forestry Group contributes to the realization of a carbon neutral and nature positive society and the effective utilization of forest resources, which are renewable natural resources produced from natural capital, through the manufacture and distribution of timber and building materials and its wooden construction and renewable energy businesses.

As for the first phase of our long-term vision "Mission TREEING 2030," we have announced a three-year "Mission TREEING 2030 Phase 1" (2022 -2024) of Medium-Term Management Plan, which provides the groundwork for our future growth and contribution to decarbonization. Fiscal 2024 is the final year of the plan. Our Mid-Term Management Plan "Mission TREEING 2030 Phase 2" was launched in fiscal 2025 under the theme of "Three Years of Reform and Implementation for Dramatic Growth." We will identify forms of contribution to the concept of nature positive through the establishment of a circular bioeconomy.

Expression for Support of the TCFD and TNFD

Changes in the natural environment, such as climate change and biodiversity, affect the Sumitomo Forestry Group's performance in various ways because its business focuses on forests and trees. For this reason, the Sumitomo Forestry Group has been among the first to respond to the recommendations of international initiatives such as the Task Force on Climate-related Financial Disclosure (TCFD) and Task Force on Nature-related Financial Disclosure (TNFD).

In response to the TCFD recommendations of 2017, the Sumitomo Forestry Group expressed its support for the recommendations in July 2018, and conducted its first TCFD scenario analysis in September 2018 as part of a project supported by Japan's Ministry of the Environment.

On the other hand, as for the TNFD, it took more than two years from the call for its launch at the G7 Environment Ministers' Meeting in May 2019 to the official establishment of the Task Force and Forum. After v0.1 of the TNFD framework beta version was released in March 2022, v0.3 was released in November 2022, reflecting user feedback. Sumitomo Forestry utilized v0.3 to conduct a trial analysis based on TNFD's LEAP approach in the area of timber procurement, where the Group has accumulated the most data. We disclosed its results in Sustainability Report 2023, released in April 2023. In response to the release of the final TNFD recommendations (v1.0) in September of the same year, Sumitomo Forestry registered as a TNFD Early Adopter in December. From the end of 2023 through 2024, Sumitomo Forestry conducted analyses based on TNFD's LEAP approach in four business segments, excluding the Lifestyle Services Business, and disclosed its results in Sustainability Report 2024 released in April 2024.

Our response to TCFD and TNFD (chronological timeline)

| Developments around the world | TCFD | TNFD | |

|---|---|---|---|

| 2017 | Jun. TCFD announced its recommendations | ||

| 2018 |

Jul.

Expressed its support of the TCFD recommendations

Sept.

Conducted its first TCFD scenario analysis

Covered the following two divisions Timber and Building Materials Business Division Housing Division |

||

| 2019 | Jul. First disclosure of information based on the TCFD recommendations in the Sustainability Report, etc. | ||

| 2021 | Jun. TNFD was established |

Oct.

Conducted its second TCFD scenario analysis

Covered the following two divisions Environment and Resources Division Global Housing and Real Estate Business Division |

|

| 2022 | Mar. TNFD released its beta version v0.1 Nov. TNFD released its beta version v0.3 |

May.

Compiled and disclosed the results of its second TCFD scenario analysis

Sept.

Conducted its third TCFD scenario analysis

Conducted covering all businesses within the Group |

Feb.

Participated in TNFD Forum

Dec.

Conducted trial analysis based on TNFD's LEAP approach in framework beta version v0.3

Scope: Timber Procurement Sector |

| 2023 | Sept. TNFD announced its final recommendations | Apr. Compiled and disclosed the results of its TCFD scenario analysis |

Apr.

Disclosed results of its trial analysis

Dec.

Became a TNFD Early Adopter

Conducted analyses based on TNFD's LEAP approach Scope: Four Business Sectors Excluding the Lifestyle Services Business |

| 2024 | Jan. TNFD announces the Early Adopter program at the WEF in Davos | Apr. Compiled and disclosed the results of its analyses | |

| 2025 and beyond |

|

||

In preparing this report, we have referred to the disclosure recommendations in the TCFD and TNFD recommendations and have made every effort to disclose information in all areas.

Governance

The Sumitomo Forestry Group responds to climate change and nature related issues primarily at the Sustainability Committee, chaired by the President and composed of members made up of Board of Directors concurrently serving as Executive Officers and each Divisional Manager. The Sustainability Committee analyzes risks and opportunities of medium to long-term sustainability issues related to the Sumitomo Forestry Group and formulates and promotes measures and initiatives. The committee members also oversee progress management of the Mid-Term Sustainability Targets, which incorporate business strategies toward achieving the SDGs, monitor implementation and effectiveness of the "Our Values" and Sumitomo Forestry Group Code of Conduct. All activities at committee meetings are reported to the Board of Directors, which are then reflected in business execution.

The Sumitomo Forestry Group Human Rights Policy, formulated in accordance with international standards such as the United Nations Guiding Principles on Business and Human Rights, sets forth the Group's commitment to respect the human rights of all people involved in its business operations, including indigenous peoples, local communities, affected stakeholders, and other stakeholders, which represents a priority in its efforts to address nature-related issues. Similarly, the Sustainability Committee manages the situation in terms of human rights, and reports to the Board of Directors.

In February 2022, we made partial revisions to our executive compensation system to further integrate our business and sustainability, and introduced compensation linked to the achievement rate of sustainability indicators. A system, where in the event that Sumitomo Forestry fails to meet its long-term targets for greenhouse gases emissions reduction certified as Science Based Targets (SBT), the amount of remuneration paid will be reduced from the regular stock remuneration amount in accordance with the degree of target performance. We have also published our long-term vision, "Mission TREEING 2030," which is divided into "Mission TREEING 2030 Phase 1" (2022-2024), "Mission TREEING 2030 Phase 2" (2025-2027) as Mid-Term Management Plans, and a sustainability chapter for the Mid-Term Sustainability Targets. We are managing the progress of each plan.

- Click here for related information

Strategy

Regarding climate change, we considered the situation in 2030 based on two scenarios: a 4°C scenario where climate measures lag, and a 1.5/2°C scenario reflecting progress toward decarbonization. We conducted an assessment of the financial impact and discussed response measures for particularly significant risks and opportunities.

Regarding nature-related issues, from the end of 2023 to 2024, we organized a working group consisting of members from the headquarters and business divisions to conduct an analysis using the LEAP approach regarding dependence/impact on nature, risks and opportunities. The findings of this working group were compiled in March 2024.

The main opportunities and risks identified in the TCFD scenario analysis and those identified in the analysis based on TNFD's LEAP approach are as follows.

Forests and trees, the core of Sumitomo Forestry Group's business, absorb and fix atmospheric carbon as they grow, while at the same time nurturing biodiversity and providing ecosystem services. These characteristics led to common or similar results for several items in the TCFD scenario analysis and analysis based on TNFD's LEAP approach, suggesting that in the Sumitomo Forestry Group's business, efforts toward decarbonization are also expanding nature-related business opportunities.

For details on the TCFD scenario analysis and the analysis based on TNFD's LEAP approach, please also refer to the related information.

Key Risks and Opportunities Identified by TCFD and TNFD

| Division*1 | Business | Transition Risks | Physical Risks | Opportunities | |

|---|---|---|---|---|---|

| Timber and Building Materials Business | Distribution and manufacturing of timber and building materials | C |

Cost increase due to introduction of carbon tax and stricter environmental regulations Increased wood procurement costs due to higher reforestation costs |

Decrease in value of wood and sales due to growing preference for more robust buildings as a result of more severe disasters |

Increase in demand for renovation to environmentally conscious housing due to stricter environmental regulations, and increase in sales of timber and building materials Increase in sales due to development of processing technology for materials for environmentally conscious housing and medium- to large-scale buildings |

| C ・ N |

Costs increase due to compliance with stricter laws and regulations related to illegal and unsustainable forest harvesting Costs increase due to higher wood procurement prices in response to increased demand for wood products to promote decarbonization, etc. |

Sales decrease and restoration costs increase due to severe flood damage from heavy rain and other factors or due to shutdown of operations Sales decrease and restoration costs increase due to suspension of operations following landslide in planted forests near plants Procurement costs increase due to reduced wood supply resulting from disasters and ecological degradation at procurement sites |

Sales increase owing to biorefinery technology and new product development Sales increase due to development of new products for the mass timber market Sales increase due to development of new products that contribute to the circular economy in the construction market |

||

| N |

Costs increase to comply with stricter soil and water pollution laws and regulations Sales decrease due to friction with local communities and NGOs caused by the construction of forest roads in areas that affect the surrounding ecosystem Increased costs of dealing with litigation and complying with stricter laws and regulations due to the impact of waste, water use, soil contamination, and land alteration on protected areas, etc. |

Sales decrease due to less water available in the surrounding area as a result of reduced water availability Sales decrease due to shutdowns caused by fire, land subsidence, tsunami, and landslides in the event of an earthquake Sales decrease due to shutdown of operations caused by fire and volcanic ash during a volcanic eruption |

Procurement costs decrease due to conversion from natural wood to wood from planted forests Reduction of water procurement costs through further water conservation in manufacturing processes and reduced and more efficient water use Costs decrease by maintaining stable raw material procurement in conjunction with resident-involved timber production (social forestry) |

||

| Housing Business | Custom-built houses, subdivision houses, greening (in Japan) |

C |

In the short term, technological development costs and construction costs for LCCM housing* and medium- to large-scale buildings will increase The value of wood will decline relatively over the long term due to the advancement of decarbonization technologies for steel, concrete, and other building materials, and sales of wooden buildings will decline |

Decrease in sales of timber and building materials due to growing preference for more robust buildings as a result of more severe disasters |

Increasing demand and sales of LCCM (Life-Cycle Carbon Minus) homes in response to growing decarbonization orientation Sales increase of environmentally conscious multi-family housing due to customer preferences, policy changes, etc. |

| C ・ N |

― |

Sales decrease due to construction delays caused by increased disaster risk Increased costs of premium payments to insurance companies due to increased disaster risk |

Sales increase due to sales at premium prices in conjunction by enhancing natural symbiotic functions (greening, water retention/permeable pavement, biodiversity initiatives, etc.) within housing and construction sites | ||

| N | Costs increase due to compliance with stricter laws and regulations associated with adverse impacts on surrounding communities and ecosystems due to waste, water use, and soil contamination | ― |

Reduced industrial waste disposal costs by curbing waste generation and promoting the conversion of waste into valuable resources Costs (e.g., greenkeeping) decrease through green space management with reduced ecological impact (e.g., reduced use of pesticides and fertilizers, less intense pruning, etc.) Sales increase owing to the increased trust of client companies and the realization of long-term contracts as a result of an increase in the number of users from the development of the environmental education business, as well as the identification and protection of rare and native plant species in parks in the designated management operations |

||

| Global Construction and Real Estate Business | Detached houses business (overseas), building materials manufacturing (United States), real estate development (Japan and overseas) | C |

Cost increase due to introduction of carbon tax and stricter environmental regulations Brand value loss due to delay in complying with environmental regulations, stock price slump, and sales decline |

Increased material procurement costs due to construction damage, extended construction time, and supply chain disruptions caused by severe disasters Intensifying competition to secure development sites due to a shift in demand to areas with less risk of disasters |

Increasing demand for environmentally conscious housing in response to the growing trend toward decarbonization among customers Expansion of the market for medium- to large-scale wooden constructions in response to ESG demand from investors and financial institutions |

| C ・ N |

Costs increase due to higher wood procurement prices in response to increased demand for wood products to promote decarbonization, etc. | Increased costs of insurance premium payments for properties under construction due to increased risk of natural disasters | Sales increase owing to the acquisition of new customers who value the natural environment following enhanced natural symbiotic functions (greening, water retention/permeable pavement, biodiversity initiatives, etc.) within housing and construction sites | ||

| N |

Increased pollution control costs due to delay in introduction of technologies to reduce environmental impact Costs increase due to delays in introducing technologies to reduce the impact on ecosystems (e.g., noise and vibration control, dust control, planting with native species, etc.) |

― |

Costs decrease through promotion of efficient construction methods (panelization and trussing) during construction Sales increase from the development of new products reusing waste materials Sales increase owing to improved reputation among customers as a result of procurement of certified wood, use of recycled wood, and certification of plants |

||

| Environment and Resources Business | Forest management, seedling production, and biomass power generation | C |

Decrease in wood production due to stricter forest protection policies Increased cost of installing energy-efficient heavy equipment due to the introduction of carbon taxes and stricter environmental regulations |

Increased forest road networks damage and road repair costs due to changes in precipitation and weather patterns Increased forest fires due to higher average temperatures, increased wood procurement and reforestation costs |

Increased demand for logs and wood due to customers' preference for decarbonization Increased demand for renewable energy due to strengthened decarbonization policies, and increased sales of biomass-derived energy business |

| C ・ N |

Costs increase due to compliance with stricter laws and regulations following the introduction of policies to promote certification of woody biomass feedstock and PKS Costs increase due to higher fuel costs resulting from increased demand and tougher competition for woody biomass feedstock and PKS Costs increase due to further changes in forest management practices to meet the growing demand for sustainable timber Costs increase due to delays in the introduction of efficient and advanced forestry technology |

Sales decrease due to shutdown of operations caused by forest fires or landslides | Sales increase from the generation of carbon credits in connection with the promotion of forest and peatland management and forest fund operations | ||

| N |

Sales decrease due to unplanned shutdowns following criticism from local communities and NGOs for timber production that violates the rights of indigenous and local people Sales decrease and costs increase as a result of delays in introduction of woody biomass fuels with less impact on ecosystems |

― |

Sales increase owing to sales of forest management technologies such as remote sensing, drone surveys, satellite applications, etc. Sales increase through payment program development (PES) from companies and local governments that benefit from the forest's public benefits (groundwater recharge, habitat provision, landslide prevention, etc.) Sales increase through the provision of industrial tourism and eco-tourism products (e.g., sales of products utilizing traditional knowledge and culture) Reduced industrial waste disposal costs by promoting the conversion of incineration ash into valuable resources Sales increase by promoting the credit market through participation in rulemaking for biodiversity credits |

||

| Lifestyle Services Business | Nursing home operations and insurance business, etc. | C | Decrease in sales of gasoline card business due to shift from gasoline to electric vehicles |

Increase in costs for renovation of owned facilities and BCP response due to the severity of disasters Decrease in customers using owned facilities due to rising temperatures and increased costs for safety considerations |

Increase in insurance subscribers, shorter policy periods, more frequent renewals, and sales due to more severe disasters Increase in the number of Sumirin Denki subscribers due to customers' preference for renewable energy Customer acquisition by responding to customers' desire for decarbonization and for safety and security in the face of increasingly severe natural disasters |

(C): Items identified only through TCFD scenario analysis

(C/N): Items identified from both TCFD scenario analysis and analysis based on TNFD's LEAP approach

(N): Items identified only through analysis based on TNFD's LEAP approach

*1The Lifestyle Services Business underwent TCFD scenario analysis only

*2LCCM housing: houses that reduce CO2 emissions during construction, occupancy, and demolition, and also generate renewable energy using solar power generation, etc., to achieve negative CO2 emissions over their entire life cycle

- Click here for related information

Management of Risks and Impacts

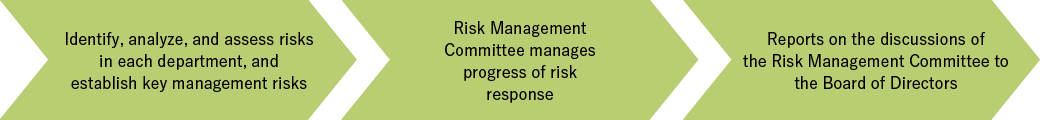

At the Sumitomo Forestry Group, each department decides on specific countermeasures and evaluation indicators for business risks, and reports progress to the Risk Management Committee on a quarterly basis. The Risk Management Committee is chaired by the President. Committee members consist of Divisional Managers and designated General Managers of each division, General Manager of the Corporate Planning Department, Personnel Department, Legal Department, IT Solutions Department, and Sustainability Department.

In addition, medium- to long-term risks related to sustainability issues are discussed extensively covering the entire value chain by the Sustainability Committee, chaired by the President and whose members consist of Executive Officers also appointed as Director, and Divisional Managers. From fiscal 2024, the Sustainability Committee increased the number of times it meets annually from four to six.

- Click here for related information

Management process of business risks

Process for managing medium- and long-term risks in response to sustainability issues

Metrics and Targets

The Sumitomo Forestry Group has established long-term targets related to climate change and is promoting initiatives and incorporating them into its Mid-Term Management Plan "Mission TREEING 2030 Phase 1" (2022 - 2024) and "Mission TREEING 2030 Phase 2" (2025-2027) and its annual plans. In 2017, the Group declared its intention to formulate SBTs and formulated new Group-wide greenhouse gases emissions reduction target, which were approved as SBTs in July 2018. In November 2024, we obtained certification for newly established net zero target by 2050, as well as for the FLAG sector targets. In accordance with SBT Guidance, we have updated our short-term goals for 2030 and have obtained the relevant certification.

To reduce greenhouse gas emissions, we joined RE100 in March 2020, an international initiative aiming for 100% renewable energy for electricity consumption. We are accelerating our initiatives to cut greenhouse gases emissions to achieve the goal of using 100% renewable energy for the electricity used in the Group's business activities and for the fuel for power generation in our power generation business by 2040. Under the "Mid-Term Sustainability Targets Phase 1 (2022-2024)" and "Phase 2 (2025 -2027)", each division will set its own target for the ratio of renewable energy procurement, and it will take necessary budgetary measures, including capital investment, to steadily promote initiatives toward achieving RE100.

We also disclose data corresponding to core global metrics and core sector metrics set forth in the TNFD final recommendations.

- Click here for related information

- Home

- Sustainability

- Environment

- Disclosures Based on the Four Pillars of TCFD and TNFD