- Home

- Sustainability

- Environment

- Sustainable Forest Management

- Forestry Fund Operation

Forestry Fund Operation

Basic Policy

Characteristics of Forest Assets and Forest Investments

Forest assets are tangible assets characterized by their uniqueness as a sustainable natural capital—trees continue to grow regardless of economic conditions. Forest assets are considered to have a low correlation with the price fluctuations of traditional financial assets, such as stocks and bonds, and have therefore been chosen as alternative investments from a risk diversification perspective. In general, forest investment is conducted through forestry funds, funds established and managed by fund managers specializing in forest investments that are known as TIMOs*1. This investment approach has developed and matured since the 1980s primarily in the United States. In simple terms, a forest fund is a scheme in which capital entrusted by investors is used to acquire and manage forest assets, and the returns generated through forest management are returned to the investors.

Contributing to Global Climate Change Mitigation

Driven by international frameworks, such as the Paris Agreement, efforts to achieve carbon neutrality are accelerating globally. Amid these global trends, forests, which are recognized as one of key nature-based solutions (NbS)*2, are increasingly valued for their role as carbon sinks, and their importance continues to grow in the pursuit of a decarbonized society one concrete example is a machanism.

Engaging in the Forestry Fund Business

Since its foundation, Sumitomo Forestry has been engaged in forest management for many years, starting with its company-owned forests in Japan. It has also built a track record of forestry management in Southeast Asia and Oceania. Building on this expertise we have cultivated to date and aiming to contribute to global climate change mitigation efforts, we took a step toward in setting up our own forest fund business by establishing a forest asset management company Eastwood Forests, LLC (hereafter EF) in October 2022.

*1Timber Investment Management Organizations

*2Nature-Based Solutions: Actions to protect, sustainably manage, and restore natural and human-modified ecosystems in ways that effectively and adaptively address societal issues while simultaneously providing benefits for the well-being of humans and biodiversity (the definition provided by the International Union for Conservation of Nature)

Sumitomo Forestry Group's Forest Fund Business

In June 2023, we commenced operations of our first fund, the Eastwood Climate Smart Forestry Fund I (hereafter "the Fund"). The Fund is managed by Eastwood Forests, LLC (EF), together with partners who possess extensive knowledge and experience in forestry fund management. EF is located in North Carolina, USA, and it is responsible for the operations of the forestry fund, including the acquisition and management of forest assets.

Features and Structure of the Fund

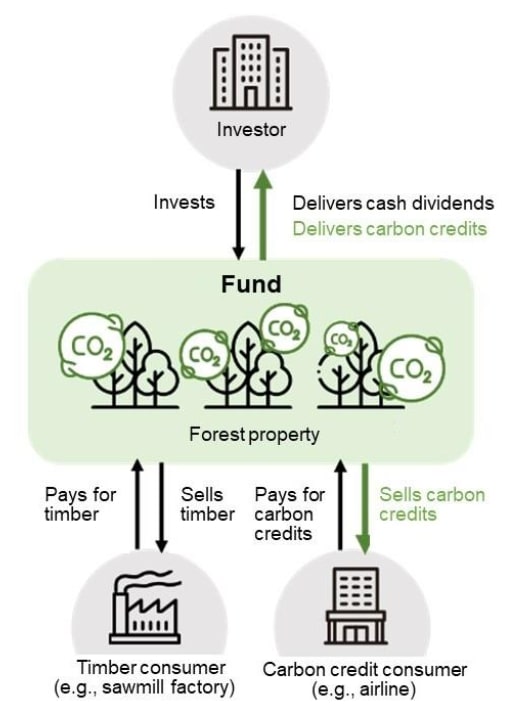

Ten Japanese companies, including Sumitomo Forestry, are participating in the Fund, with an asset size of approximately 60 billion yen and a 15-year investment period. By leveraging the Fund’s structure, forests can be properly managed at a scale of area and capital that would be unattainable individually, thereby contributing to global climate change mitigation efforts. The Fund engages in the acquires of forest assets in mainly North America, where there is a developed market and system for forest asset transactions, and sales of wood and carbon credits obtained through sustainable forest management. As of the end of February 2025, approximately 90,000 hectares of forest has been acquired across the United States, Canada, Panama, and Costa Rica.

Sumitomo Forestry Asset Management Co., Ltd., a wholly owned subsidiary of Sumitomo Forestry, provides support to the Fund from the Japanese side, including fund formation and communication with investors after fund formation.

The Structure of the Fund

Forest assets acquired through the forestry fund

- Home

- Sustainability

- Environment

- Sustainable Forest Management

- Forestry Fund Operation